End-to-End Loan Management, Engineered on timveroOS

Operate loan management your way on the TIMVERO loan management platform.

Automate posting, reconciliations, and collections with policies-as-code; manage hardship, reversals, and recoveries in one auditable framework. Choose between cloud or on-premises deployment to gain complete control of data, compliance, and cost.

An Easy Choice Between SaaS Speed and Custom Control

SaaS loan management systems launch quickly but limit flexibility and audit depth. Custom builds offer control but come with long delivery cycles and high maintenance costs. The timveroOS platform by TIMVERO delivers all-in-one: faster deployment, reasonable costs, and full governance, with policies-as-code for posting, hardship, and collections logic that runs entirely in your environment.

SaaS solutions

timveroOS

Custom Development

New Feature

timveroAI for Loan Management

From operating model to a governed loan management system

timveroAI automates how lenders configure and deploy their loan management environments. It interprets operational requirements, such as portfolio hierarchies, posting rules, reconciliation logic, and event handling, and assembles them into executable components on the timveroOS framework.

Portfolio logic generator

Workflow orchestrator

Reconciliation and control assembly

Reusable configuration templates

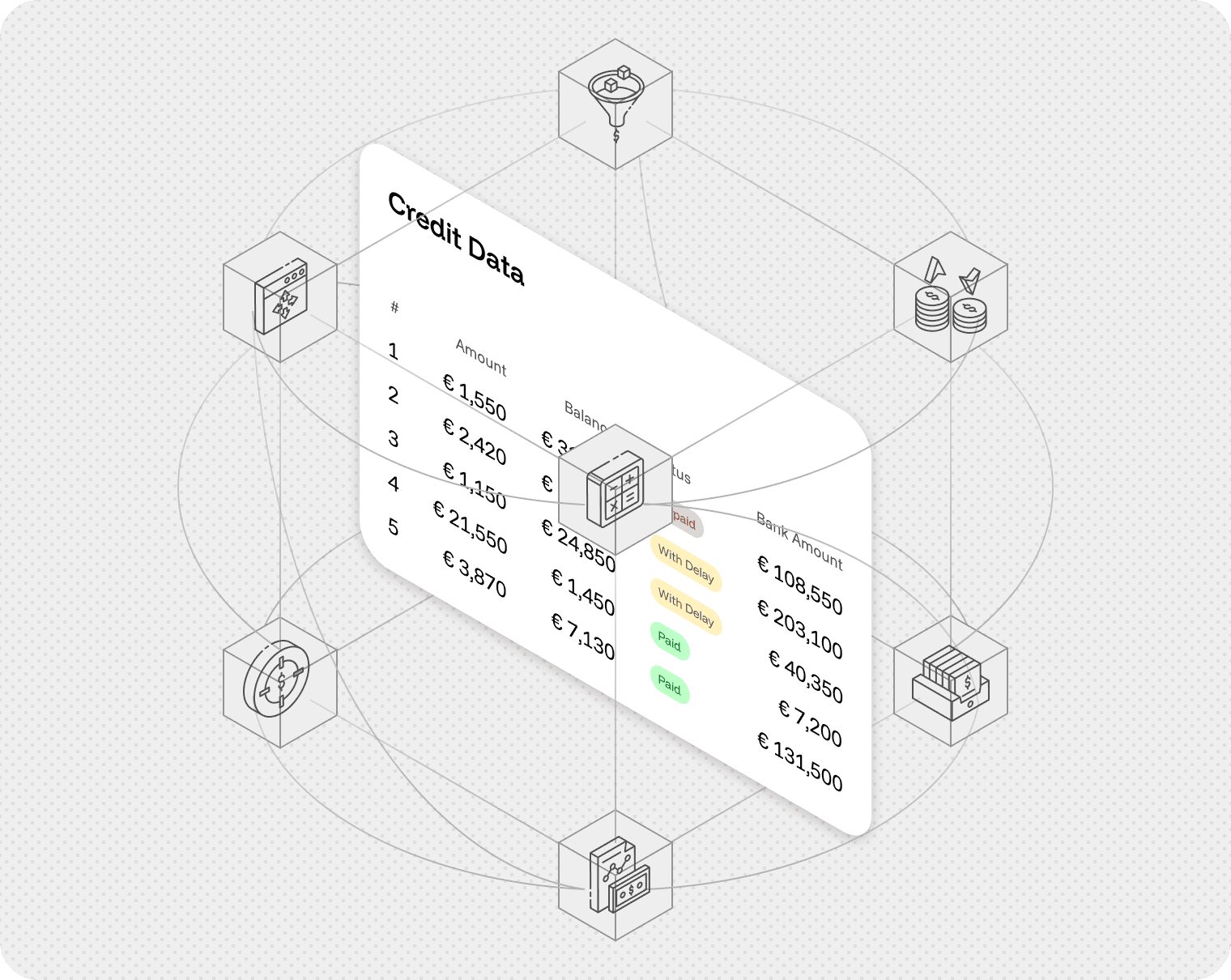

Loan Management Architecture Designed for Control and Scalability

Running in a chosen environment for complete data and release ownership

Deploy the timveroOS platform in the cloud or on-premises. You retain full control over code, data, and releases while meeting internal security and data-residency standards. Open SDKs and APIs connect seamlessly to core, GL, rails, and bureaus, delivering predictable TCO and zero dependency on vendor timelines.

Authoring every posting and event rule as explainable, versioned code

Define and adjust posting hierarchies, fee tables, hardship options, and collections rules as policies-as-code. Each action records its inputs, calculations, and approvals with reason codes, helping to ensure consistent outcomes and audit-ready traceability across reporting cycles and regulatory reviews.

Composing and extending LMS modules without rewrites

Start with billing, payment ops, account maintenance, and collections modules, then extend or replace them in code. timveroOS SDKs, event bus, and connector kits let teams add portals, workflows, or analytics layers without touching the core platform—maintaining control, compliance, and agility as portfolios evolve.

Driving Down Loan Management Costs Through Intelligent Automation

Automate posting, adjustments, and reconciliation end-to-end while moving repetitive account maintenance to self-service. The loan management solution by TIMVERO enforces policies-as-code to eliminate manual exceptions, standardize outputs, and flag breaks before they hit finance. As a result, leaner operations, faster close cycles, and audit-clean portfolios across products and geographies.

Adaptive autopay orchestration

Dynamic posting hierarchy

Continuous reconciliation engine

Configurable self-service workflows

Strengthening Collections with Explainable, Audit-Ready Governance

timveroOS connects delinquency, hardship, and recoveries in one governed framework with full provenance. timveroAI predicts cure probability, prioritizes cases, and orchestrates outreach cadence automatically. Each decision, from promise-to-pay to charge-off, is logged, explainable, and regulator-ready, helping lenders recover faster while maintaining policy consistency.

Early-risk detection signals

Automated outreach and cadence logic

Governed hardship and restructuring flows

Unified recoveries ledger

One Loan Management Platform for Every Lending Institution

Banks

Manage consumer/SME/auto portfolios with policies-as-code, precise schedules, GL cleanliness and bureau reporting. Keep everything in your environment and integrate to core and rails through open APIs.

Fintechs

Scale digital servicing with portals, wallet/ACH/card rails, instant payoff quotes and explainable posting - iterate without waiting on vendor roadmaps.

Credit Unions

Deliver assisted branch + digital servicing, manage hardship/forbearance, and avoid per-seat fees with predictable TCO - while keeping data and releases under your control.

6

Customer Experience

Case studies

Get a demo

See how the timveroOS platform by TIMVERO automates loan management, from booking to recoveries, under full governance.

Ready to start?

Upgrade your loan management system for small businesses and large enterprises in just 3 months.

Get our free TIMVERO product guide

.avif)