Own Your Consumer Lending Stack - Faster Approvals, Cleaner Servicing

Build lending that moves as fast as your customers.

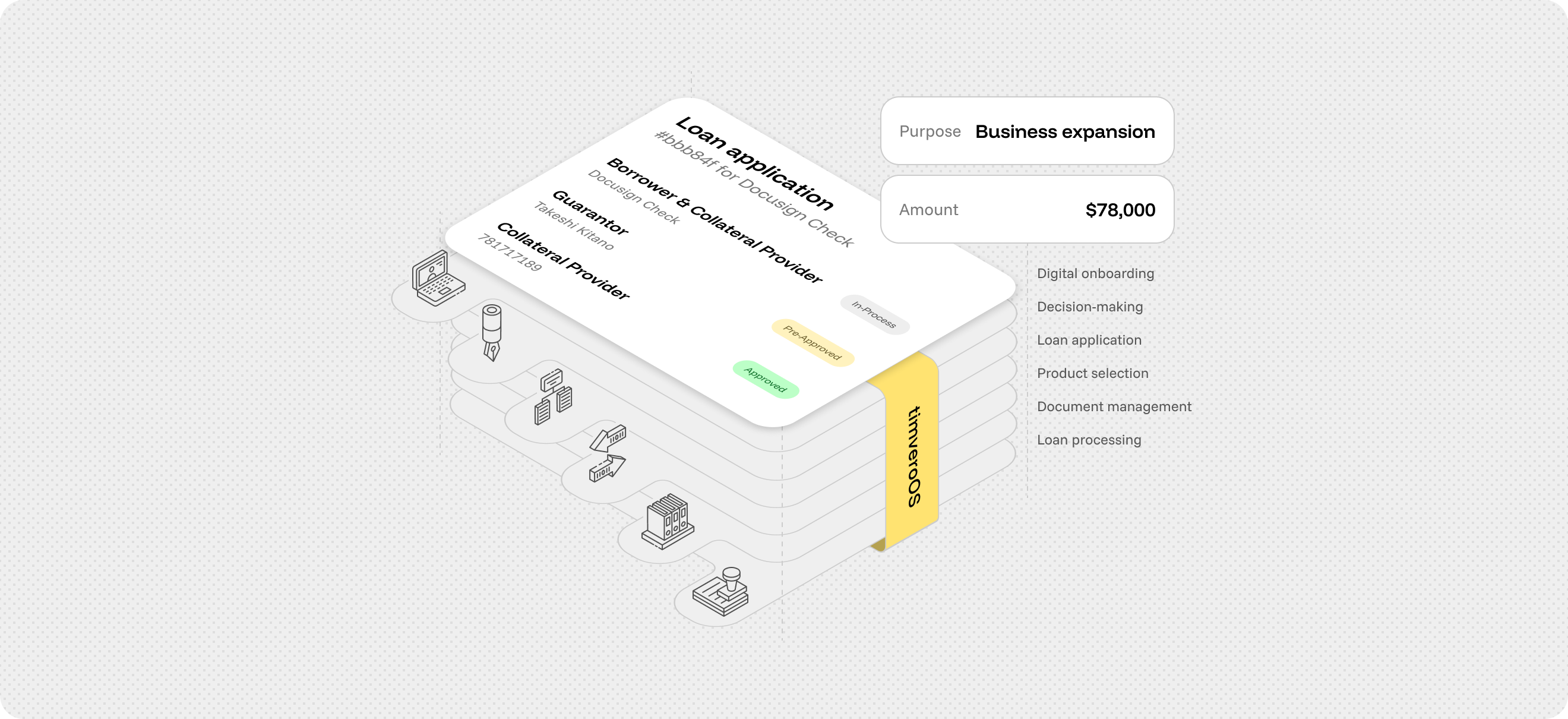

timveroOS unites onboarding, underwriting, e-sign, disbursement, and collections in your environment. The result: fewer exceptions, faster launches, and servicing that scales with demand. Run KYC/AML and open-banking checks, encode affordability and pricing as policy, generate explainable offers and e-sign, then service at scale, without giving up control of your data, code, or releases.

1

Stages

End-to-end Lending Lifecycle, Configured to Your Policies

Consumer lending is a chain of high-stakes steps: acquisition, approvals, contracts, and servicing. On timveroOS, each stage runs the way your bank or fintech needs it: compliant, automated, explainable.

From pre-qualification through disbursement and collections, each stage is configurable in UI and code, so your affordability rules, pricing waterfalls, and compliance checks run exactly as designed.

Instant onboarding with built-in compliance

Consumer lending starts with trust. On timveroOS, borrowers complete KYC/AML checks in minutes through digital onboarding. Identity, income, and device signals are automatically verified, while bureau and open-banking data are integrated into affordability and DTI calculations. Exceptions are routed to governed overrides, so risk teams stay in control without slowing the flow. Every approval, rejection, or manual step is audit-logged for regulators and internal committees. The result: higher conversion, fewer drop-offs, and a data trail that helps ensure compliance, without adding operational drag to your front office.

Approvals you can explain to risk and regulators

timveroOS combines bureau files with transaction-level income and expense features to model true affordability. Credit cutoffs, DTI ratios, and offer waterfalls are encoded directly as policy, not buried in code. That means every “yes” or “no” is fully explainable, with reason codes available to applicants, analysts, and regulators. Risk teams can introduce new thresholds in hours instead of months. Even manual overrides are governed, versioned, and logged. This creates an underwriting engine that is fast, transparent, and always aligned with your lending policy.

Close loans faster with compliant offers and clean disbursements

What used to require multiple systems now happens in one governed workflow - reducing leakage, lowering operational costs, and improving the borrower experience from contract to cash. timveroOS assembles offers with APR, terms, fees, and autopay options pulled directly from encoded rules. Contracts are generated automatically and signed digitally. Before funds move, the platform validates bank accounts and fraud signals, then disburses via ACH, wire, or payout partners. Every payment schedule is posted to the GL and pushed to borrower portals with payoff calculators and reminders.

Service borrowers at scale, manage hardship with empathy

Servicing is where lending relationships are tested. timveroOS automates billing and autopay while allowing borrowers to adjust dates or request extensions online. Hardship and forbearance workflows are built-in, ensuring regulated treatment while keeping costs under control. The platform flags pre-delinquency risk early, triggering outreach before issues escalate. Collections teams benefit from automated dunning strategies and promises-to-pay tracking, while finance teams reconcile bank files and bureau reporting automatically. Portfolio dashboards highlight cure probabilities and charge-off exposure. The result: lower operating expense, fewer surprises, and servicing that balances compliance with customer care: at scale.

2

Architecture

Lending Architecture That Adapts to You, Not the Other Way Around

Consumer lending platform built on timveroOS is capable of modelling applicants, co-applicants, accounts, devices, bureau and open-banking data, documents and configurable flows. These building blocks let you assemble personal loans, debt consolidation or checkout installments, fully extensible in code and integrations.

AI that Helps You Say “Yes” More Safely

AI on timveroOS works inside your environment to spot risk and opportunity. It predicts default and early-payment risk, estimates affordability from bank transactions, detects synthetic/first-party fraud, and recommends offer bundles balancing conversion and risk. All models run in your environment, remain explainable, and plug directly into pre-qual, underwriting and collections.

Approve more customers without raising losses

Detect synthetic and first-party fraud signals

Optimize APR/term/amount bundles for conversions

Catch pre-delinquency early and raise cure rates

5

How We Work

Who We Work with

in Consumer Lending

Banks and Credit Unions (Consumer Lending)

Stand up personal loans and refinancing with affordability and pricing as code, compliant e-sign and clean disbursement. Connect timveroOS to core, GL, bureaus and open banking, with audit-ready reporting for risk and finance.

Neobanks and Consumer Fintech Lenders

Launch fully digital personal loans with instant pre-qual, fraud/device checks, and scalable servicing. Keep your data, models, and releases under control while experimenting on product terms and UX.

Retail and Platforms (Embedded Finance)

Offer checkout installments with instant approvals, compliant contracts, and borrower portals. Adjust product terms and workflows without waiting for vendor roadmaps.

5

Testimonials

Customer reviews

7

Why choose us

An Easy Choice Between SaaS Speed and Custom Control

SaaS loan management systems launch quickly but limit flexibility and audit depth. Custom builds offer control but come with long delivery cycles and high maintenance costs. The timveroOS platform by TIMVERO delivers all-in-one: faster deployment, reasonable costs, and full governance, with policies-as-code for posting, hardship, and collections logic that runs entirely in your environment.

SaaS solutions

timveroOS

Custom Development

7

Framework-native

Framework-native Software for Consumer Lending: Built to Fit You

timveroOS is framework-native: 80% comes ready-made, the rest you shape. Deploy in your own cloud or on-prem, adapt flows in code, and keep ownership of data and releases. Not a black box: it’s a lending system that it completely yours.

8

Next steps

Evaluate the Platform

TIMVERO is a trusted technology vendor for banks and financial organizations on their way to impeccable digital lending. Apply for a quick real-time demo to discuss the details and get a quote.

Ready to start?

Upgrade your loan management system for small businesses and large enterprises in just 3 months.

Get our free TIMVERO product guide

.avif)