Retail Lending Built for Omnichannel Growth and Compliance

Build omnichannel retail lending on the timveroOS platform by TIMVERO.

Encode affordability and pricing as policy-driven code, run KYC/AML and open-banking checks, and generate instant offers with compliant e-sign and disbursement. Service portfolios at scale while keeping full ownership of your environment, data, and release cycle.

Start your journey

Discover how TIMVERO’s flexible solutions can elevate your operations with tailored tools and seamless integration.

Get our free TIMVERO product guide

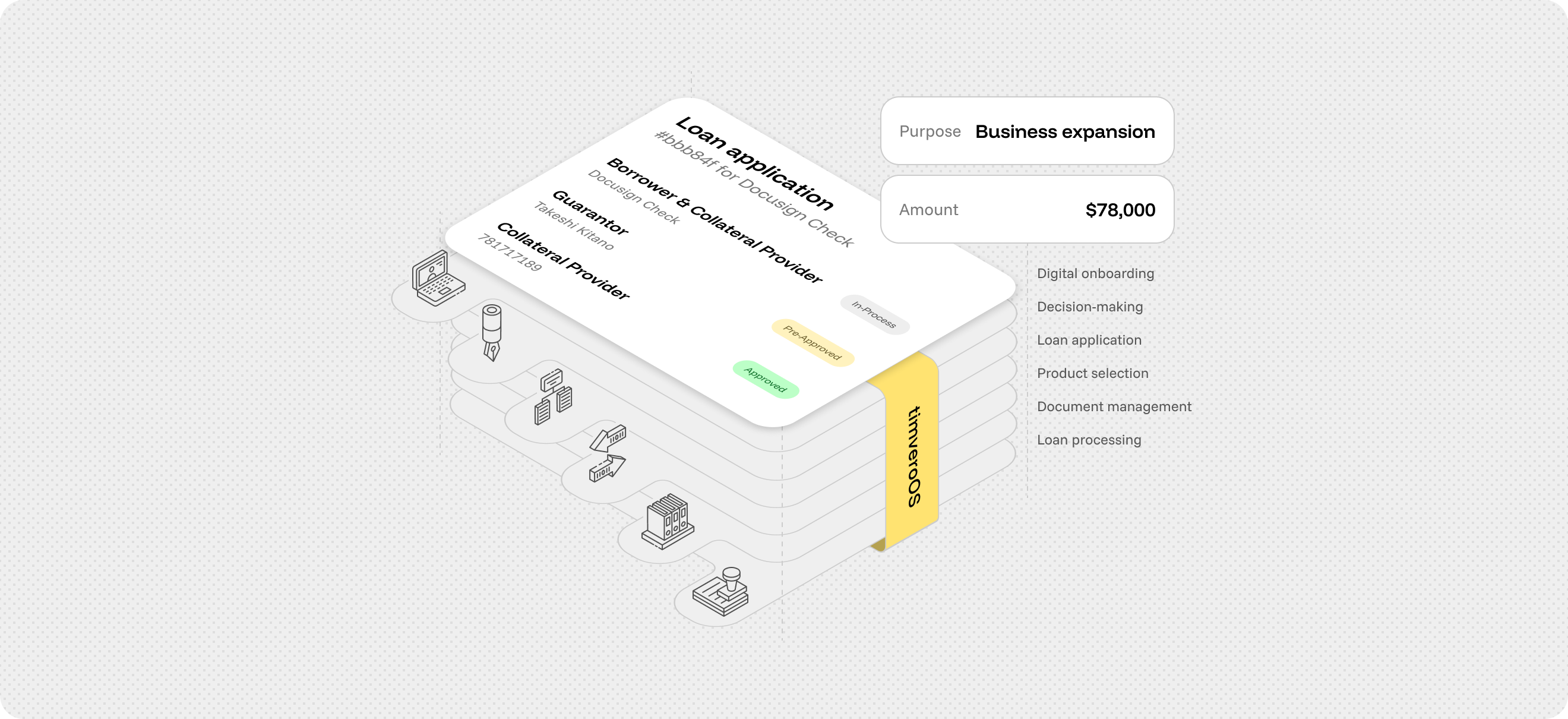

End-to-end Retail Loan Management, Configured in Code

Retail lending only works if every step—from lead capture to collections—runs seamlessly across channels and remains auditable. timveroOS connects data, policies, and flows, enabling banks and neobanks to accelerate approvals, control risk, and reduce servicing costs while meeting regulatory requirements.

Faster onboarding with pre-qual and KYC/AML

Applicants enter through a branch, app, or contact center. Identity and income are verified with KYC/AML, device checks, and, where permitted, open-banking consent. Soft bureau pulls combined with affordability/DTI rules produce instant pre-qual ranges. Exceptions route to governed overrides. The result is lower friction for customers, faster time-to-yes, and a clean audit trail.

Explainable underwriting and pricing as code

Bureau and bank-transaction data are fused to assess income stability, obligations, and surplus cash flow. Rules for affordability, DTI, and APR/term waterfalls are authored as policy-driven code. Every decision produces reason codes for applicants and committees, while models and overrides are versioned under governance. Lenders gain speed without compromising risk control or compliance.

Compliant offers with e-sign and disbursement

Offers are assembled with APR, term, payment date, and autopay options. Disclosures are generated automatically, e-signatures captured, and fraud/account checks completed. Funds are disbursed by ACH, wire, or card issuance. GL postings and schedules flow back to branch, app, or web portals. Borrowers see transparency, while finance teams maintain accuracy and compliance.

Scalable servicing with hardship and collections

Billing, autopay, reminders, and payoff quotes are automated. Borrowers can reschedule payments or enter hardship/forbearance without breaking compliance rules. Early-warning alerts trigger before delinquency; dunning and promises-to-pay are orchestrated under governance. Bank files are reconciled, bureau reports generated, and dashboards surfaced, cutting Opex, improving cure rates, and keeping regulators satisfied.

Retail Loan Software Architecture that Mirrors Reality

The timveroOS platform models applicants, households, co-applicants, and accounts alongside devices, documents, and raw/featured data from bureaus, open banking, and fraud checks. Configurable flows, pre-qual, underwrite, offer, e-sign, service, let banks assemble personal loans, overdrafts, cards, or POS installments as code, fully extensible in integrations and their own environment.

AI that Improves Decisions and Strengthens Portfolio Outcomes

AI on the timveroOS platform by TIMVERO evaluates bureau, open-banking, and device data to guide retail lending in real time. It balances conversion and risk by estimating affordability, flagging fraud, and tailoring pre-approved or cross-sell offers across products. This way, insights feed directly into underwriting and collections with full transparency for auditors and risk teams.

Affordability scoring tuned for cards, loans, and overdrafts

Fraud detection that adapts to new attack patterns

Cross-sell recommendations to raise attach rates

Pre-delinquency alerts to protect cure and recovery

The exclusive Financial Engineering/Cashflow Engine helps wipe out bottlenecks in teams, amplify business effectiveness, manage portfolio risks, uncover upsell opportunities, and shape compelling marketing with noteworthy ROI using timveroOS Analytics meticulously crafted for retail lending.

Did you know? Our analytics have demonstrated a 80% reduction in approval process time for retail loans, ensuring a swift and seamless experience for borrowers.

One Platform for Traditional

and Digital Retail Lenders

Banks and Credit Unions Expanding Retail Lending

Launch personal loans, overdrafts, credit cards, or auto refinance with affordability and pricing as code. Connect timveroOS to core systems, bureaus, and open-banking feeds. Generate compliant disclosures, automate servicing, and deliver audit-ready reporting for risk, finance, and compliance teams.

Neobanks and Digital-First Challengers

Offer instant pre-qual, fraud/device checks, and omnichannel onboarding across app, web, and contact center. Automate disbursement and servicing while keeping policies, data, and releases under your control. timveroOS helps new entrants scale without vendor lock-in and maintain compliance from day one.

Retail Finance Arms of Consumer Brands

Enable store cards, installment programs, or private-label lending with bank-grade decisioning. Settlement reconciliation, hardship handling, and bureau reporting run natively. White-label portals and APIs let teams adjust programs quickly, without losing governance or compliance. All in your own environment, not a shared SaaS.

6

Customer Experience

Case studies

Solutions for any lending type

An Easy Choice Between SaaS Speed and Custom Control

SaaS loan management systems launch quickly but limit flexibility and audit depth. Custom builds offer control but come with long delivery cycles and high maintenance costs. The timveroOS platform by TIMVERO delivers all-in-one: faster deployment, reasonable costs, and full governance, with policies-as-code for posting, hardship, and collections logic that runs entirely in your environment.

SaaS solutions

timveroOS

Custom Development

Assemble Retail Lending in Your Own Environment

The timveroOS platform by TIMVERO is delivered as a framework, not a hosted package. Modules and an SDK let you build retail lending flows in your own environment. You own the code, the data, and the release cycle — starting fast, adapting freely, and staying clear of vendor lock-in.

Get a demo

TIMVERO is a trusted technology vendor for banks and financial organizations on their way to impeccable digital lending. Apply for a quick real-time demo to discuss the details and get a quote.

Ready to start?

See how the timveroOS platform by TIMVERO powers modern retail lending.

Get our free TIMVERO product guide

.avif)