Bank Lending on a Building Platform

Launch commercial, consumer, or specialty lending products in 3–4 months - not years. timveroOS gives banks a complete lending solution with a Building Platform underneath: configure product logic and workflows in the admin panel, extend at the architectural level in standard Java/Spring Boot, and run entirely in your own environment.

Your data. Your environment.

No vendor lock-in - your codebase

Launch in 3–4 months, not years

timveroOS is built for banks that need a lending system shaped to their model

Tier 3/4 Commercial & Retail Banks

You offer commercial loans, SME lending, orconsumer installments. Your SaaS can't support your credit policy or covenantstructures without expensive professional services. You're paying changerequest fees for every product update. timveroOS gives you a Building Platform where your team configures andextends product logic - no vendor dependency for product evolution.

Credit Unions & Cooperative Lenders

You need full control over your member data and lending criteria. Multi-tenant SaaS doesn't meet your data sovereignty requirements. You want the flexibility to build unique member products - but not to build a platform from scratch. timveroOS runs in your environment. Your data never leaves your infrastructure.

Specialty & Private Credit Lenders

You run asset-based lending, construction finance, auto lending, or private credit. Standard loan schemas don't model your products. Every SaaS vendor asks you to adapt to their data model.

timveroOS lets you define your own product logic - entity structure, participant patterns, lifecycle events - using Building Platform blocks.

Build any bank lending product - without fitting your model to a vendor schema

Every banking product is assembled from Building Platform blocks. Configure your product logic in the admin panel. Extend credit policy, covenant structures, and lifecycle rules in code - not through a vendor's change request process.

Commercial & SME Lending

Configure multi-tier approval workflows, covenant logic, guarantor and co-borrower structures using Participant building blocks. Define custom amortization methods and fee schedules in the admin panel. Extend underwriting logic in Java/Spring Boot when your credit policy requires it.

Consumer & Retail Lending

Configure eligibility rules, scoring inputs, and repayment schedule types in the admin panel - no code changes for product variations. Enable multi-product origination from a single platform instance. White-label borrower portal configurable for your brand.

Auto & Asset-Based Lending

Configure asset valuation inputs, LTV logic, and collateral tracking as Building Platform blocks. Define depreciation schedules and balloon payment structures in the admin panel. Integrate with external asset registries via open API connectors.

Private Credit & Specialty Finance

Define non-standard repayment logic - revenue-based, PIK interest, step-up structures — using custom AccrualEngine configurations. Multi-entity loan structures supported via Participant building blocks. Full audit trail and compliance logging built in.

What regulated banks need from a lending platform - built into timveroOS

Data Custody & On-Premise

timveroOS runs in your cloud or on-premise environment. Your data never leaves your infrastructure - no multi-tenant commingling, no vendor data access. Full control over compliance configuration and security policies.

On-premise or your private cloud

Data sovereignty - stays in your infrastructure

No multi-tenant data commingling

Immutable audit trail for regulators

No Vendor Lock-In

Your team extends the platform in standard Java/Spring Boot. The codebase is yours - if you ever move on, you take the system with you. No proprietary tooling, no dependency on vendor's product roadmap for lending product changes.

Standard Java/Spring Boot - no proprietary tooling

Codebase stays with your team

No change request fees for product updates

Extend integrations independently

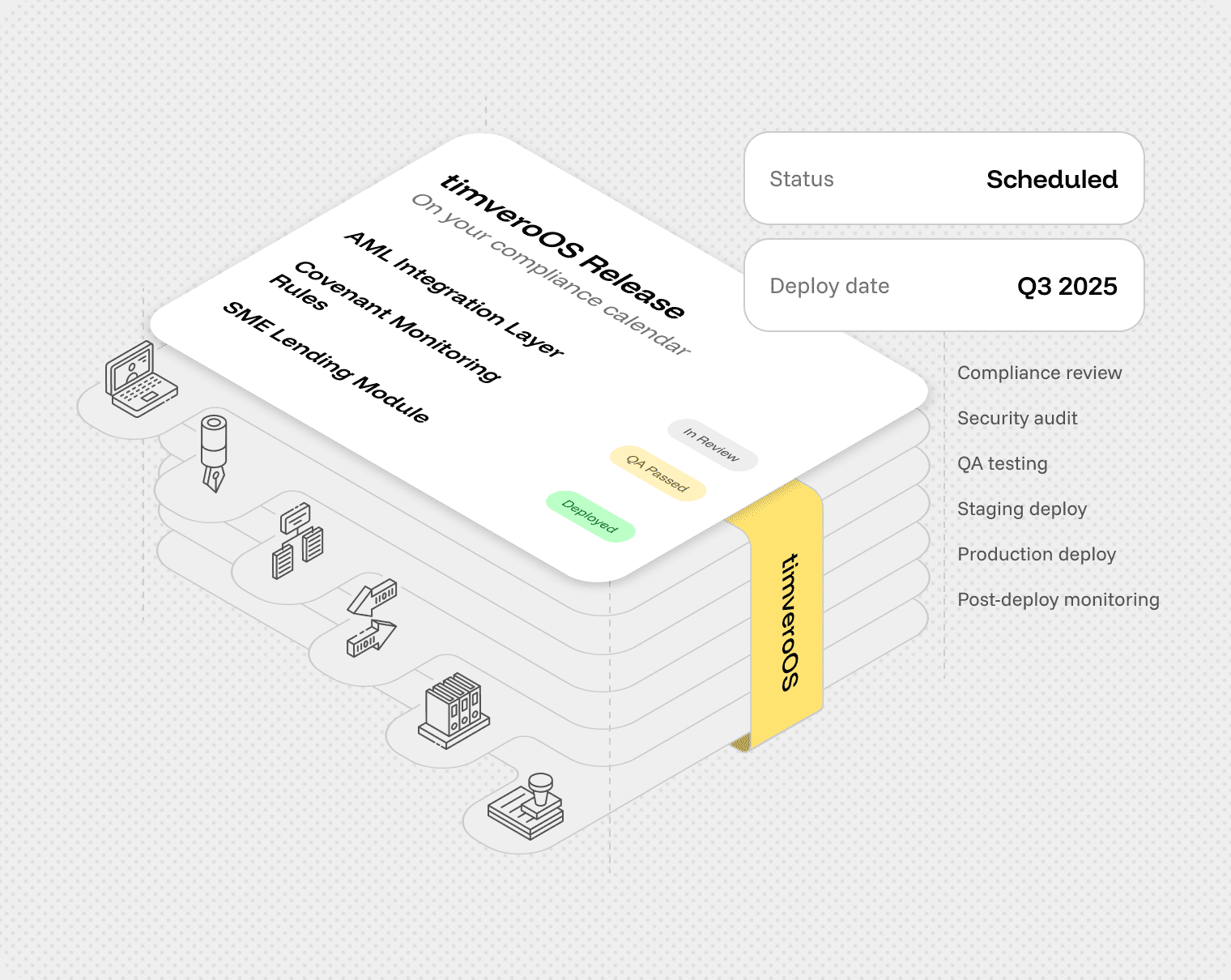

You Control the Update Schedule

Apply new versions when your compliance team, QA cycle, and IT calendar are ready. No forced upgrades, no vendor-imposed maintenance windows. Banks can't accept updates on a vendor's schedule - timveroOS is built around that reality.

Update on your compliance cycle, not vendor's

No forced upgrades or maintenance windows

Major releases twice yearly - your IT cadence

Modular updates - no full-platform re-testing

New Feature

timveroAI - scoring precision and portfolio intelligence built into your Building Platform

From application data to credit decision in under 2 seconds

timveroAI automates how banks configure and deploy their decisioning environments. It interprets credit policies, eligibility rules, and risk thresholds - and assembles them into executable components on the Building Platform.

Credit Scoring Engine

Compliance & Regulatory Reporting

Portfolio Risk Monitoring

AI Configuration Assistant

12x

faster credit decisions

+20%

profit per loan

0

coding for scoring rules

<2 sec

credit decision time

Why banks choose timveroOS over SaaS or custom builds

SaaS solutions

timveroOS

Custom Development

7

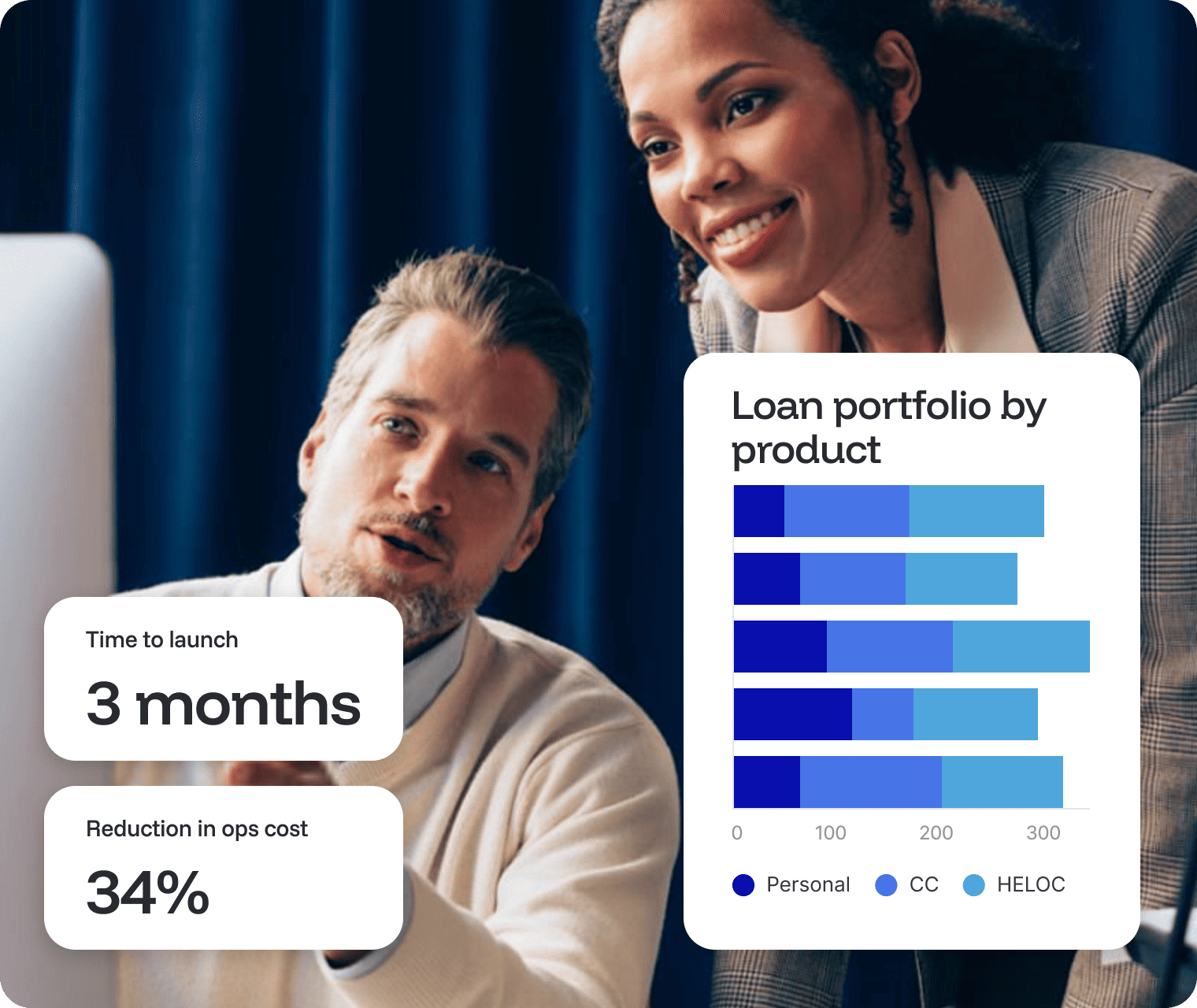

Customer Experience

Banks that launched on the timveroOS Building Platform

Ready to build your bank lending product on a Building Platform?

Talk to the timveroOS team. We'll walk you through the Building Platform blocks for your specific product - commercial lending, consumer installment, auto, or specialty finance - and show you a live demo in your context.

Start your journey today

Discover how TIMVERO’s flexible solutions can elevate your operations with tailored tools and seamless integration.

Get our free TIMVERO product guide

.avif)