Installment Loan Software, Built Your Way

Turn installment lending into a growth engine.

Choosing framework-native timveroOS, you get explainable credit decisions, precise amortization schedules, and servicing that scales. All delivered in your own environment, so you move on average 5 times faster compared with custom development without surrendering data, code, or control.

Start your journey

Discover how TIMVERO’s flexible solutions can elevate your operations with tailored tools and seamless integration.

Get our free TIMVERO product guide

One Framework for the Full Installment Journey

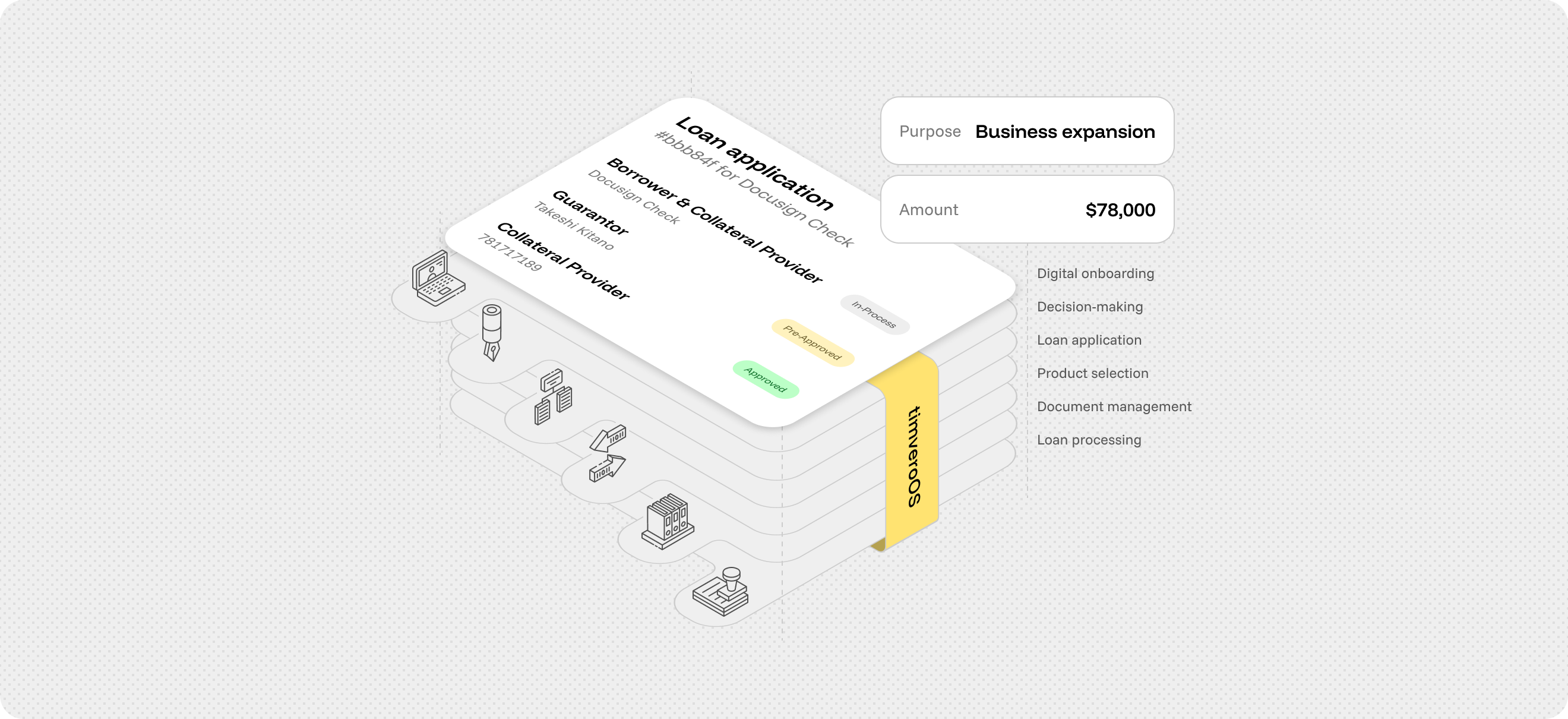

From first click to final payment, installment lending flows seamlessly with TIMVERO. Pre-qualification, decisioning, disbursement, and servicing are modeled under one architecture — policies-as-code, unified data, and versioned rules — enabling faster approvals, lower operating costs, and lifecycle-wide compliance: in-branch, on the web, or in-app.

Smarter acquisition and instant pre-qualification

You get streamlined acquisition across branch, web, and mobile. Leads are captured once and routed through built-in KYC/AML, device, and open-banking checks. Soft-pull bureau data and affordability rules generate instant pre-qual ranges with explainable reason codes. Identity and income are verified automatically, while exceptions flow through governed overrides. Every artifact and decision is versioned and audit-logged, creating a compliant data trail from the start. The result: lower drop-off rates, faster onboarding, and increased applicant trust.

Explainable risk decisions

you can trust

timveroOS unifies bureau data with open-banking insights like income stability, obligations, and cash-flow surplus. Affordability, DTI, and APR/term waterfalls are defined as policies-as-code, producing decisions that are both explainable and auditable. Secured, unsecured, and co-applicants are supported natively, while manual overrides are routed under governance. Every decision, model, and policy version is logged, creating a transparent risk framework. The result: faster approvals for qualified borrowers, reduced losses through controlled thresholds, and full explainability for applicants, risk teams, and committees alike.

Instant offers, e-sign, and payout in one flow

Your installment loan management solution assembles installment offers with APR, term, fees, and due dates, with autopay options already embedded. Disclosures are generated automatically, applicants complete e-sign within the same flow, and final fraud or account checks run in the background. Funds are disbursed via ACH, wire, or card issuance, while amortization schedules are posted directly to borrower portals. Every action, from GL postings to early-repayment handling, is versioned and audit-logged. The result: borrowers experience a simple, compliant process, while finance and legal teams gain full visibility across offers, payouts, and schedules.

Low-touch servicing with built-in hardship flows

timveroOS automates billing, autopay, and reminders while giving borrowers clear portals for balances, payoff quotes, and extensions. Payment holidays, hardship, and forbearance are handled natively, with pre-delinquency alerts triggered before defaults. Promises-to-pay, charge-offs, and recoveries are governed and logged, ensuring both consistency and compliance. Bank file reconciliation and bureau reporting are automated, while portfolio dashboards surface early-warning signals for risk and finance teams. The result: lower operating costs, higher cure rates, and greater resilience in collections: and all that within one governed servicing framework.

From Applicants to Products:

A Unified Architecture

Every object in installment lending — applicants, households, and co-applicants; accounts and devices; bureau, open-banking, and fraud data — is modeled natively in timveroOS. Document sets and configurable flows (pre-qual, underwriting, offers, e-sign, servicing) come built in. Together, they assemble personal loan, debt-consolidation, and refinance products, fully extensible in code and integrations.

AI Built for Credit Risk and Collection Scoring

AI on timveroOS predicts default and early-payment risk, estimates affordability from bank transactions, detects synthetic and first-party fraud, and optimizes offers across APR, term, and amount. Models are securely trained in your own environment and plug into pre-qual, underwriting, and collections: always explainable, governed, and audit-ready.

Affordability and default risk scoring

Fraud detection across synthetic and first-party cases

Offer optimizer for APR, term, and amount

Pre-delinquency alerts and cure probability

The proprietary Financial Engineering/Cashflow Engine builds synergy across key business teams – risk, product, marketing, and finance – facilitating swift and substantial installment loan origination and management improvements. Eliminate bottlenecks, enhance lending business effectiveness, manage portfolio risks, discover upsell opportunities, and craft lead-winning marketing with impressive ROI using timveroOS Analytics, the pinnacle of AI/ML decision-making and Cashflow Engine integration tailored for installment loans.

Trusted by Installment

Lenders Worldwide

Banks and Credit Unions (Consumer Installments)

Launch personal loans, debt consolidation, and refinancing with affordability and pricing as code, explainable underwriting, and precise schedules. Connect to your core, bureaus, and open-banking feeds, while generating audit-ready reporting for risk and finance teams.

Neobanks and Consumer Fintech Lenders

Deliver instant pre-qual, device and fraud checks, and low-touch servicing, while keeping code, data, and release control. timveroOS gives fintech lenders a compliant foundation to scale installment products without vendor dependencies.

Retail Finance Arms (Store Installments)

Offer compliant checkout and branch-assisted installment journeys with reconciliation, refunds within a white-label portal TIMVERO delivers. Adjust pricing, eligibility, and settlement rules in UI or code, so programs evolve without vendor lock-in or spreadsheet workarounds.

6

Customer Experience

Case studies

Solutions for any lending type

An Easy Choice Between SaaS Speed and Custom Control

SaaS loan management systems launch quickly but limit flexibility and audit depth. Custom builds offer control but come with long delivery cycles and high maintenance costs. The timveroOS platform by TIMVERO delivers all-in-one: faster deployment, reasonable costs, and full governance, with policies-as-code for posting, hardship, and collections logic that runs entirely in your environment.

SaaS solutions

timveroOS

Custom Development

Installment Loan Software Built as a Framework

timveroOS is not pre-packaged software. It’s a framework where applicants, products, data, and flows are modeled natively. You assemble what you need, govern every version, and keep ownership of releases — without sacrificing speed to market.

Want to Start a Pilot?

Launch an installment product quickly with timveroOS modules, then extend in code as you grow.

Ready to start?

Upgrade your loan management system for small businesses and large enterprises in just 3 months.

Get our free TIMVERO product guide

.avif)