The Lending Platform Lenders Build On

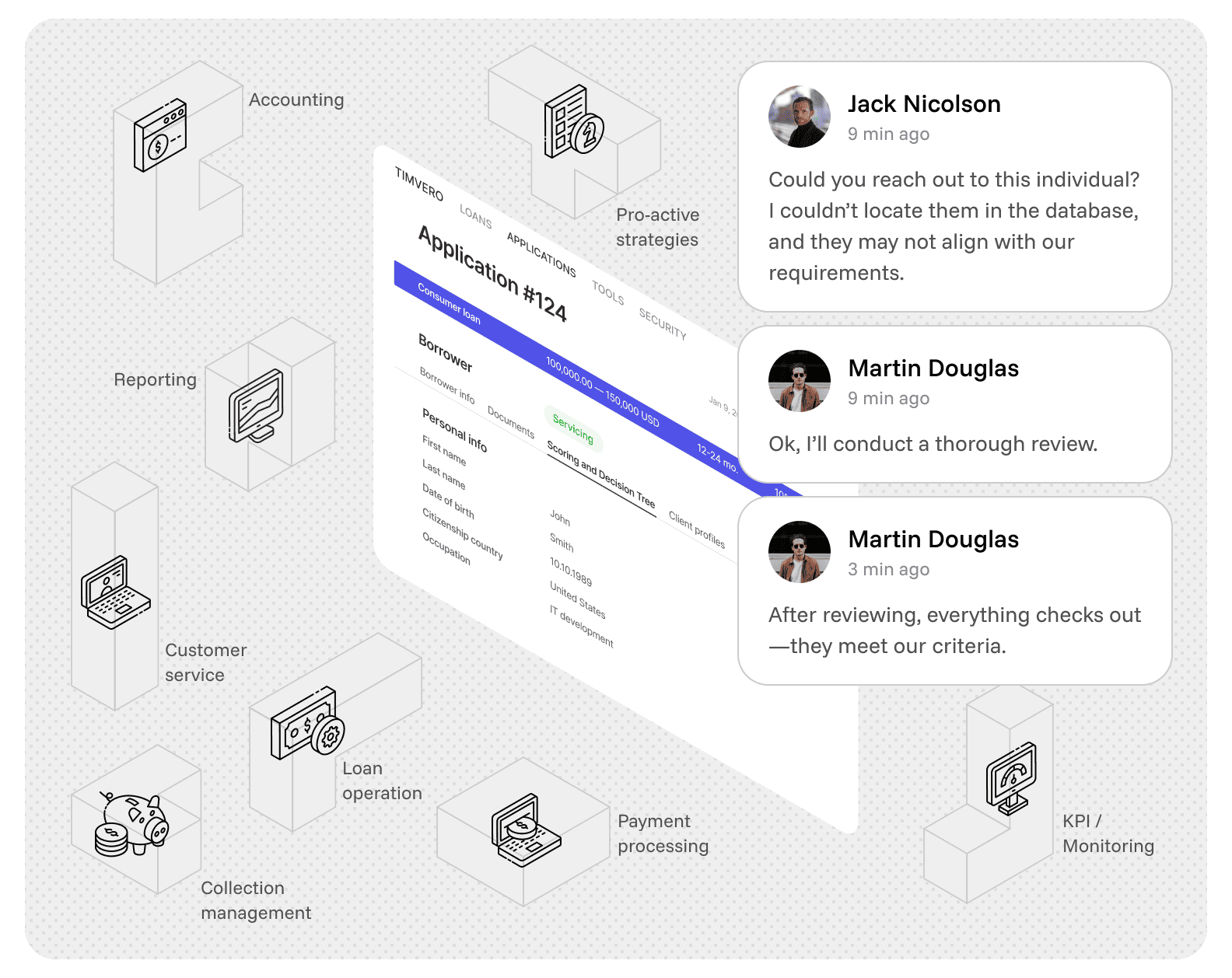

timveroOS is a complete loan management system built on a Building Platform - configurable building blocks for origination, servicing, collections, and analytics that your team shapes to any business model, product, or regulatory requirement.

Powered by timveroAI your AI implementation agent.

$5.5bn+

in loan portfolios managed

7000+

loan applications processed daily

13+

countries served globally

100k+

per year development hours saved

Start your journey

Discover how TIMVERO’s flexible solutions can elevate your operations with tailored tools and seamless integration.

Get our free TIMVERO product guide

One Platform. Three Ways to Understand It.

timveroOS is a lending solution with a Building Platform underneath. Here's what that means for your role.

For Business Leaders

For Product Owners

For Developers

timveroAI

AI that builds and optimises your lending workflows

timveroAI is the intelligence layer of timveroOS, an AI agent trained on the Building Platform's source code and deployment patterns. Describe a business requirement, and timveroAI assembles the corresponding building blocks, configures workflows, and keeps your system optimised over time. Reduce implementation time from months to weeks.

Natural-Language Setup

Predictive Analytics

Smart Maintenance

Human-in-the-loop

8×

time-to-change

5x

lower cost-to-change

0 coding

for algorithms change

100%

explain ability and compliance

The Building Platform Difference

Most loan management systems ask you to adapt your business to their software. timveroOS is different the Building Platform adapts to you. Here's what that means in practice.

Own Your Platform, Own Your Data

Self-hosted or cloud-deployed, timveroOS runs in your environment. Your data never leaves your infrastructure. The codebase is yours, no vendor lock-in, no forced upgrades, no dependency on anyone else's roadmap. The Building Platform gives you the control that no SaaS can offer.

Launch in Weeks.

Not Months

Pre-built Building Platform modules for origination, servicing, collections, and analytics cover 80% of the lending lifecycle. With timveroAI, new products go live in 3–6 weeks instead of 4–6 months. Your team fills the remaining 20% custom business logic that no packaged solution could anticipate.

Compliance Built Into the Architecture

Every product rule, approval workflow, and policy change is versioned as code with a full audit trail. IFRS 9 provisioning, regulatory reporting, and adverse action notices are Building Platform blocks configurable, traceable, and regulator-ready. Audits don't require scrambling.

An Easy Choice. When You See It Side by Side

SaaS solutions

timveroOS

Custom Development

One Building Platform. Every Stage of the Lending Journey.

Every module in timveroOS is a Building Platform block. They run independently and connect on a single data, policy, and compliance layer. Configure in the admin panel. Extend in code. Own it completely.

Loan Origination System (LOS)

Loan Servicing System (LSS)

Collections & Recovery

Risk & Compliance

AI Portfolio Analytics

Built for Every Lender Who Refuses to Compromise

For Banks

timveroOS gives your team a Building Platform where you configure and extend product logic without vendor dependency. Data stays in your environment. Updates happen on your compliance schedule.

For Fintechs

The Building Platform covers 80% of the lendinglifecycle out of the box. timveroAI reduces implementation from months toweeks. Iterate your product logic without waiting for anyone's sprint.

For Credit Unions

timveroOS runs in your environment. Your data never leaves your infrastructure. Predictable subscription pricing - no per-seat traps. Full control over member-specific lending criteria.

Specialty & Private Credit

The Building Platform lets you define your own product logic entity structures, participant patterns, and lifecycle events. Invoice-level ledger for factoring. Revenue-based repayment for private credit.

6

Customer Experience

What Lenders Build on timveroOS

What's New

Ready to See the Building Platform in Action?

Book a technical demo tailored to your product type - commercial lending, consumer installment, or specialty finance. We'll show you the Building Platform blocks for your specific use case, live in your context.

Ready to start?

Upgrade your loan management system in 3 months. No vendor lock-in. Your environment. Your data.

Get our free TIMVERO product guide

.avif)