Construction Lending With Explainable Approvals and C2P Conversion

One system for every project: timveroOS for construction loan management without blind spots.

TIMVERO unifies onboarding, budget setup, inspections, draw requests, disbursements, lien/title updates, and final closeout. Borrowers and GCs use portals; inspectors capture photos and % complete; finance posts clean GL entries; risk monitors variance and covenants. Every rule is coded, every packet audit-ready, and every conversion predictable.

Start your journey

Discover how TIMVERO’s flexible solutions can elevate your operations with tailored tools and seamless integration.

Get our free TIMVERO product guide

An End-to-End Lifecycle That Prevents Over-Advances and Errors

You can own the platform that manages every stage of construction lending in governed flows: from project onboarding and budget setup to inspections, draw approvals, disbursements, and closeout or C2P conversion. Each step is configurable in code and UI, ensuring compliance with lien/title practices, variance control, and audit-ready documentation without manual rework.

Faster onboarding with budgets built in

timveroOS streamlines borrower, developer, and general contractor onboarding by capturing permits, insurance, contracts, and guarantees in a single flow. Budgets are defined with Schedule of Values (SOV), contingency, and retainage already embedded, while change-order governance is configurable as policy. Eligibility, equity-in, and concentration limits run as policies-as-code, ensuring consistency across facilities. Integrations to LOS, core systems, and title partners remove re-keying. Every approval, role, and artifact is versioned and logged for audit. The outcome: onboarding moves faster, budgets are transparent from day one, and compliance evidence is always readily available.

Inspections and draws with lien compliance

Draw administration is digitized end-to-end. Borrowers and GCs submit draw requests with invoices and lien waivers through portals. Inspectors capture mobile photos and percentage complete against the SOV, automatically linking progress to budgets. timveroOS generates title update requests and validates conditional/unconditional waivers and insurance status in the same flow. Each draw packet consolidates documentation for committee review, with exceptions routed via governed overrides and retainage logic applied automatically. The result: faster draw cycles, clean audit packets, and strong protection against over-advances or lien disputes.

Disbursements and accounting without rework

Disbursements are governed by budget and equity-in rules to prevent over-advances before funds move. timveroOS supports escrow, joint-payee checks, and staged payments, while automatically accruing interest reserves. Fees and interest post cleanly to the GL and reconcile to bank files without manual intervention. Change orders and re-forecasts adjust future headroom transparently. Borrowers and GCs see schedules, balances, and headroom directly in portals. The effect: finance teams close faster, exceptions drop, and reconciliations stay clean month after month.

Monitoring, closeout, and C2P conversion

Project monitoring continues beyond draws. timveroOS tracks variances, delays, and punch lists with early-warning alerts for slippage or covenant breaches. At project end, the system collects final waivers, certificate of occupancy, and lien releases, then generates title policies and closeout documentation. Retainage is released only after compliance checks are satisfied. For construction-to-permanent (C2P) programs, transparent conversion rules apply rate and term, escrow, and payoff logic seamlessly. The result: predictable conversions, fully auditable closeouts, and reduced exposure from unresolved lien or title issues.

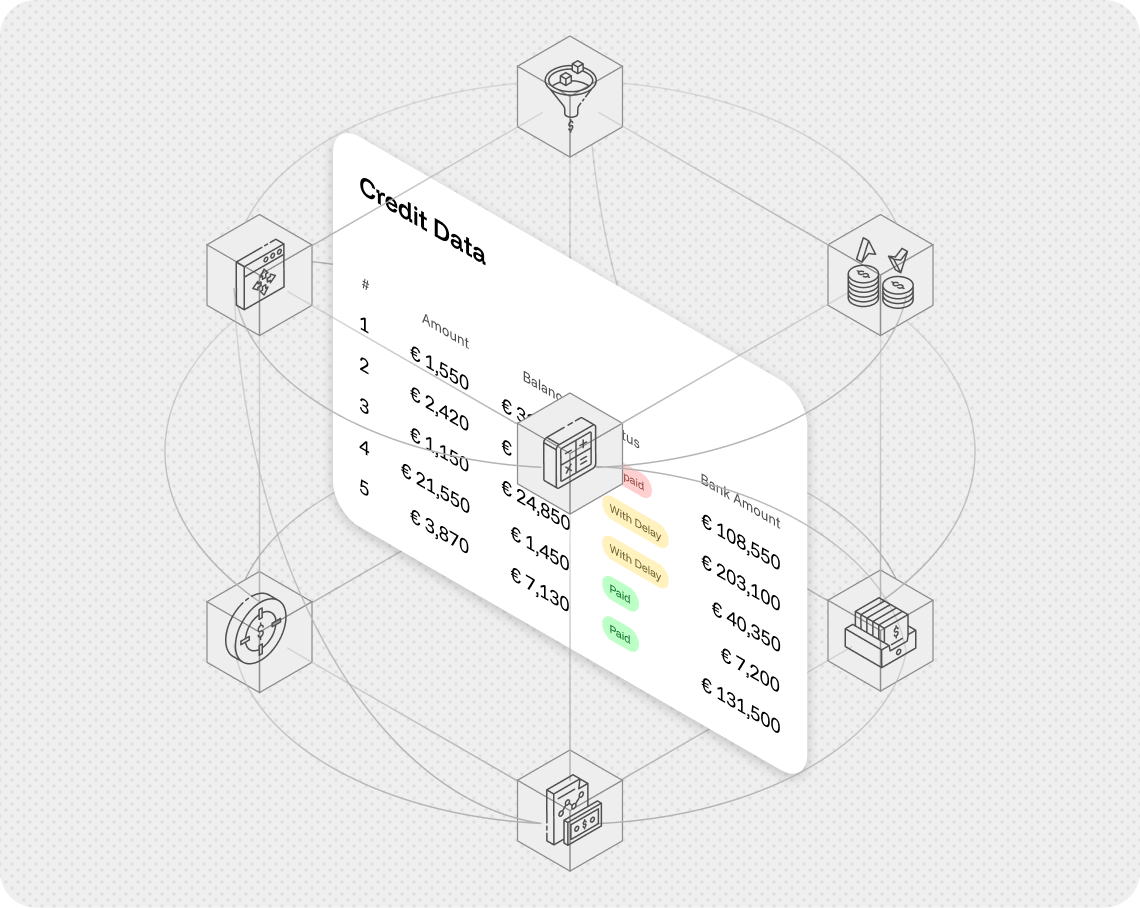

The Data Model That Powers Construction Lending at Scale

The timveroOS platform models borrowers, developers, and GCs alongside collateral, inspectors, and subs. Project data — SOV, invoices, waivers, title updates — flows into configurable processes like onboarding, inspection, draw, disbursement, and closeout. Construction, rehab, bridge, and C2P programs are assembled natively, fully extensible in code and integrations, and always audit-ready.

.svg)

Smarter Inspections and Safer Disbursements With AI

AI in the timveroOS platform by TIMVERO strengthens construction lending, where manual review leaves blind spots. Models estimate % complete from inspections and spend, predict delays and cost overruns, and flag forged waivers or invoices. Draw timing and cash-flow forecasts are optimized to reduce disputes. Every model runs in your environment on project data, documents, and payment history, fully governed, explainable, and audit-ready.

Percent-complete and delay risk predictor

Budget-variance early warning

Waiver and invoice forgery detection

Optimal draw timing and cash-flow forecast

TIMVERO’s Financial Engineering/Cashflow Engine eliminates team bottlenecks, enhances business efficiency, manages portfolio risks, identifies upsell opportunities, and crafts compelling marketing strategies with remarkable ROI, all tailored for construction lending. Experience a 13% increase in profit per loan as our AI/ML decision-making module accelerates executive decisions, continually refining underwriting, services, and product development through data analytics.

TIMVERO Construction

Lending Customers

Banks and

Credit Unions

Stand up residential and commercial construction programs with policies-as-code for budgets, retainage, and lien/title compliance. Connect timveroOS to LOS, core, appraisal, inspection, and title systems. Deliver audit-ready draw packets and reporting to risk and finance, while reducing manual rework and accelerating time-to-yes across the portfolio.

Specialist Construction Lenders and Private Credit

Run ground-up, rehab, bridge, and C2P programs with strict over-advance prevention, rapid inspections, and automated exception routing. Draw/budget policies run as code, lien and waiver validations are logged, and reconciliations post cleanly to GL. Data stays in your own environment, ensuring predictable costs and governance at scale.

Fintechs and

Builder Platforms

Embed draw management and borrower/GC portals to digitize the lending experience. timveroOS provides instant headroom views, inspection checklists, waiver tracking, and automated title updates. New programs and features can be launched quickly, without waiting on a vendor roadmap, while maintaining compliance and transparency across projects and participants.

6

Customer Experience

Case studies

Solutions for any lending type

An Easy Choice Between SaaS Speed and Custom Control

SaaS loan management systems launch quickly but limit flexibility and audit depth. Custom builds offer control but come with long delivery cycles and high maintenance costs. The timveroOS platform by TIMVERO delivers all-in-one: faster deployment, reasonable costs, and full governance, with policies-as-code for posting, hardship, and collections logic that runs entirely in your environment.

SaaS solutions

timveroOS

Custom Development

Assemble Construction Lending in Your Own Environment

The timveroOS platform by TIMVERO is not off-the-shelf SaaS. It is a framework of modules and an SDK that allows you to assemble your own construction-lending system within your environment. Borrowers, GCs, inspectors, budgets, waivers, and title updates are modeled natively. You own code, data, and releases, starting fast, extending freely, and scaling without vendor lock-in.

Get a demo

Take control of construction lending with the timveroOS platform by TIMVERO, faster draws, transparent budgets, lien and title compliance, and predictable C2P conversions. Assemble your system in your own environment, free from vendor lock-in.

Ready to start?

Upgrade your loan management system for small businesses and large enterprises in just 3 months.

Get our free TIMVERO product guide

.avif)