Loan servicing software

Flexible due to SDK, easy-to-deploy, and powered with analytics – timveroOS for commercial and consumer lending is an industry-leading vendor of digital banks.

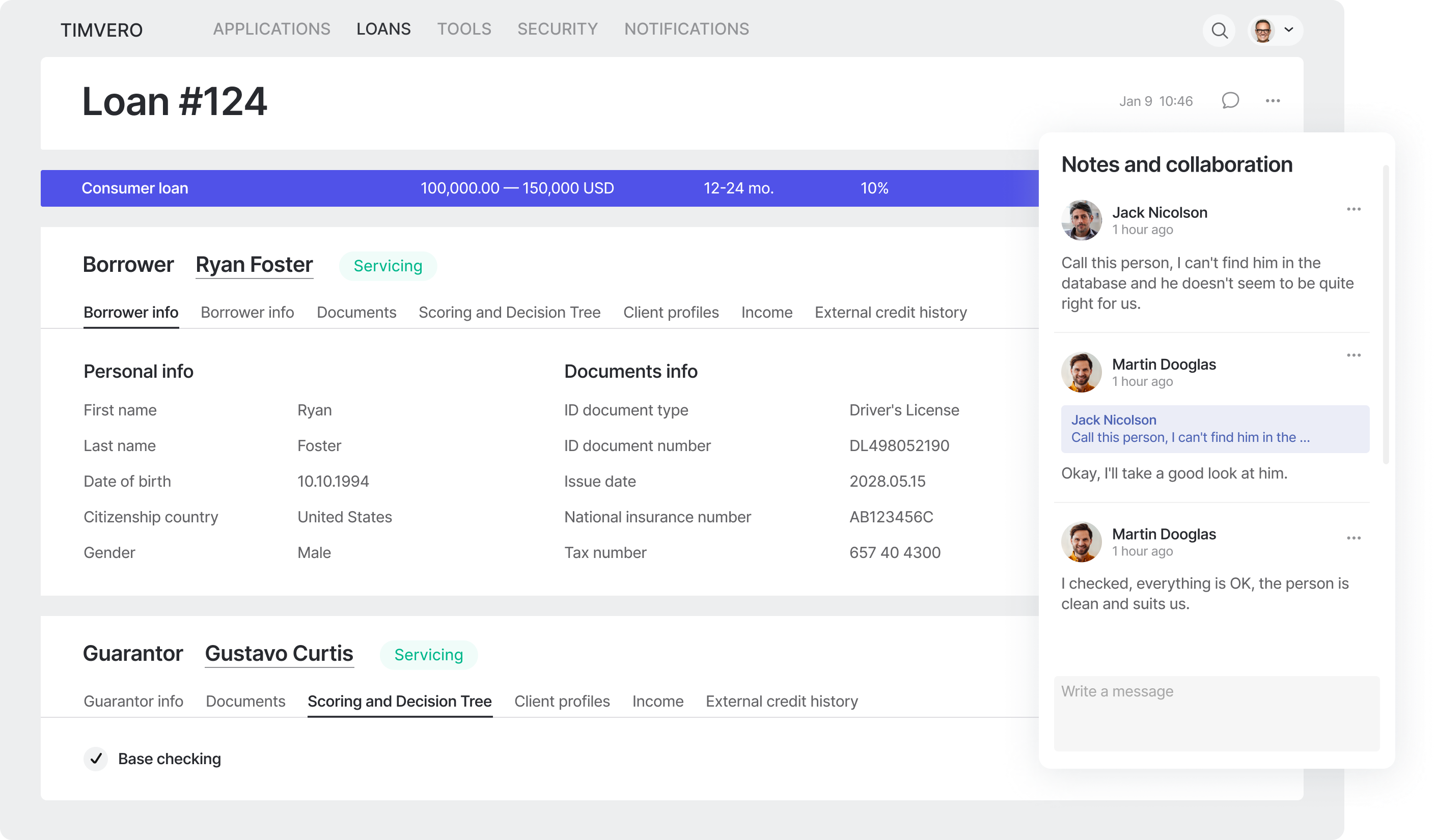

All-in-one loan servicing platform from TIMVERO automates lending business at scale: from disbursements to calculations, notifications, payment registration, overdue loan management, and collection.

End-to-end automation of loan servicing

Get loan management, financial and user analytics, disbursements, and repayments in a single interface with tiered access for your employees - all that at reasonable self-maintenance costs.

SDK-powered business

flows

Easy customization of business processes, loan statuses, and cohort targeting due to the software development kit - faster than custom development, and more flexible than out-of-the-box loan servicing solutions.

Multichannel approach

Quality loan management for users on any device: convenient forms, interfaces, and notifications across mobile, web, vendor, and customer portals. Ensure smooth business performance with a single loan software platform.

Proactive loan servicing strategies

Benefit from a number of predefined lending management strategies: a reassessment, limits adjustment, and bad pattern recognition. Adjust or add your own strategies to tailor the system to your business needs with the help of SDK.

Loan reconciliation and schedule adjustment

Smart automated reconciliation helps track the performance of various loan products, keep a high performance of loan portfolio, and make data-based business decisions. Schedule adjustment ensures matching the platform functionality to real lending processes.

Upsell and cross-sell functionality

The TIMVERO software for loan services provides robust functionality for marketing and sales purposes, including analytics, notification, customer segmentation, and personalized offers.

End-to-end automation of loan servicing

Get loan management, financial and user analytics, disbursements, and repayments in a single interface with tiered access for your employees - all that at reasonable self-maintenance costs.

SDK-powered business flows

Easy customization of business processes, loan statuses, and cohort targeting due to the software development kit - faster than custom development, and more flexible than out-of-the-box loan servicing solutions.

Multichannel approach

Quality loan management for users on any device: convenient forms, interfaces, and notifications across mobile, web, vendor, and customer portals. Ensure smooth business performance with a single loan software platform.

Proactive loan servicing strategies

Benefit from a number of predefined lending management strategies: a reassessment, limits adjustment, and bad pattern recognition. Adjust or add your own strategies to tailor the system to your business needs with the help of SDK.

Loan reconciliation and schedule adjustment

Smart automated reconciliation helps track the performance of various loan products, keep a high performance of loan portfolio, and make data-based business decisions. Schedule adjustment ensures matching the platform functionality to real lending processes.

Upsell and cross-sell functionality

The TIMVERO software for loan services provides robust functionality for marketing and sales purposes, including analytics, notification, customer segmentation, and personalized offers.

Customer feedback

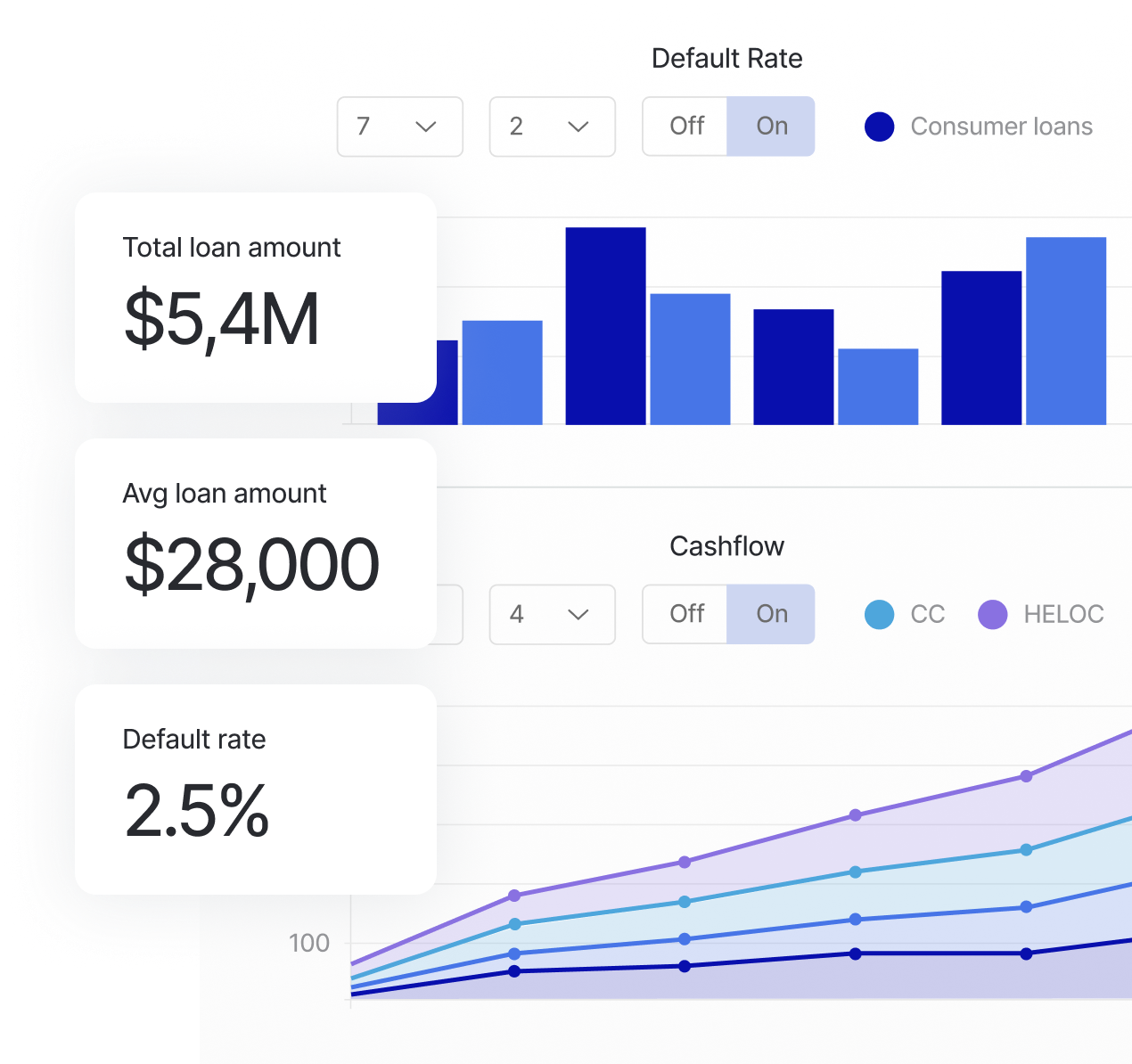

Hi-tech applicable analytics

Digital transformation is more than repeating the already existing basic functionality in a banking app. Artificial Intelligence in financial services is a buzzword, but few financial service providers get the most out of it.

TIMVERO created the XAI-first approach for banks and financial institutions (XAI – explainable AI).

The implementation of AI-processed data has never been that easy: every department of your bank or financial organization receives refined and timely reports for 12 times faster and more effective decision-making. Outpace competitors with a smart XAI approach in digital loan servicing.

timveroOS is there to match advanced technology with financial business needs.

What it means:

The timveroOS integration and data transformation modules pick and analyze data from widely sources data pools, such as customer actions, repayments, or communications.

Analytics XAI engine generates genuine recommendations based on this data. These recommendations include process improvements, repayment, collection analysis, and more.

Automated cashflow projections allow your financial institution to estimate the potential business impact of every further action or decision without having ML engineers on board.

The timveroOS integration and data transformation modules pick and analyze data from widely sources data pools, such as customer actions, repayments, or communications.

Analytics XAI engine generates genuine recommendations based on this data. These recommendations include process improvements, repayment, collection analysis, and more.

Automated cashflow projections allow your financial institution to estimate the potential business impact of every further action or decision without having ML engineers on board.

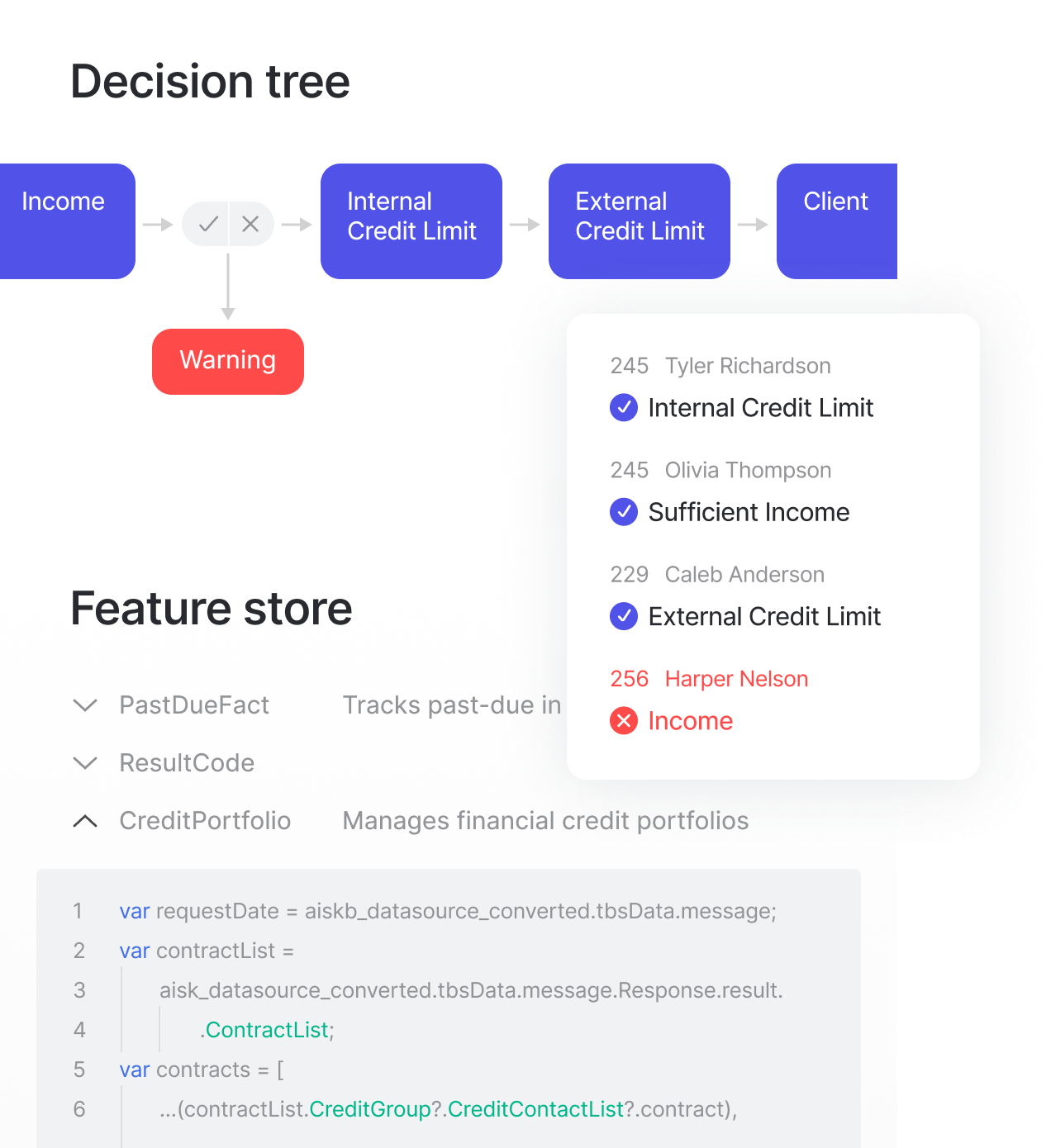

Automated data-centric decision-making

- Build proactive loan management strategies in the no-code environment in a few clicks

- Link nodes, checking, and paths to CRM events or data points

- Connect ML-powered scoring models if necessary

How we work

Visit a personalized platform demo

Spend 45 minutes with maximum effectiveness: ask questions and get a high-quality navigation through timveroOS that highlights features and solutions for your business requirements.

After the demo, our analysts will make the necessary calculation and reach out with a ready plan for the project start.

Have a loan servicing platform released

As a rule, it takes up to 3 months to build and kick off the updated loan servicing system for your bank or financial institution. During this time our team either tailors the system to your needs or provides SDK training and support for your in-house team navigating it to tangible results the fastest way possible.

Enjoy the full functionality of servicing

Cut your operating costs, speed up loan management processes, and set up automated decision-making and tech-powered analytics for smart decisioning. TIMVERO provides it all and always exceeds your expectations. Being a reputable bank lending software vendor, we bring your greatest ideas to life and select the optimum route.

Visit a personalized platform demo

Spend 45 minutes with maximum effectiveness: ask questions and get a high-quality navigation through timveroOS that highlights features and solutions for your business requirements.

After the demo, our analysts will make the necessary calculation and reach out with a ready plan for the project start.

Have a loan servicing platform released

As a rule, it takes up to 3 months to build and kick off the updated loan servicing system for your bank or financial institution. During this time our team either tailors the system to your needs or provides SDK training and support for your in-house team navigating it to tangible results the fastest way possible.

Enjoy the full functionality of servicing

Cut your operating costs, speed up loan management processes, and set up automated decision-making and tech-powered analytics for smart decisioning. TIMVERO provides it all and always exceeds your expectations. Being a reputable bank lending software vendor, we bring your greatest ideas to life and select the optimum route.

Get a demo

If your bank is ready for a loan servicing system launch or upgrade - the TIMVERO team is there to be a full-fledged technology partner with extra attention to your functional requirements, business goals, and available resources.

Apply for a free live demo now to upgrade your lending business in just 3 months.