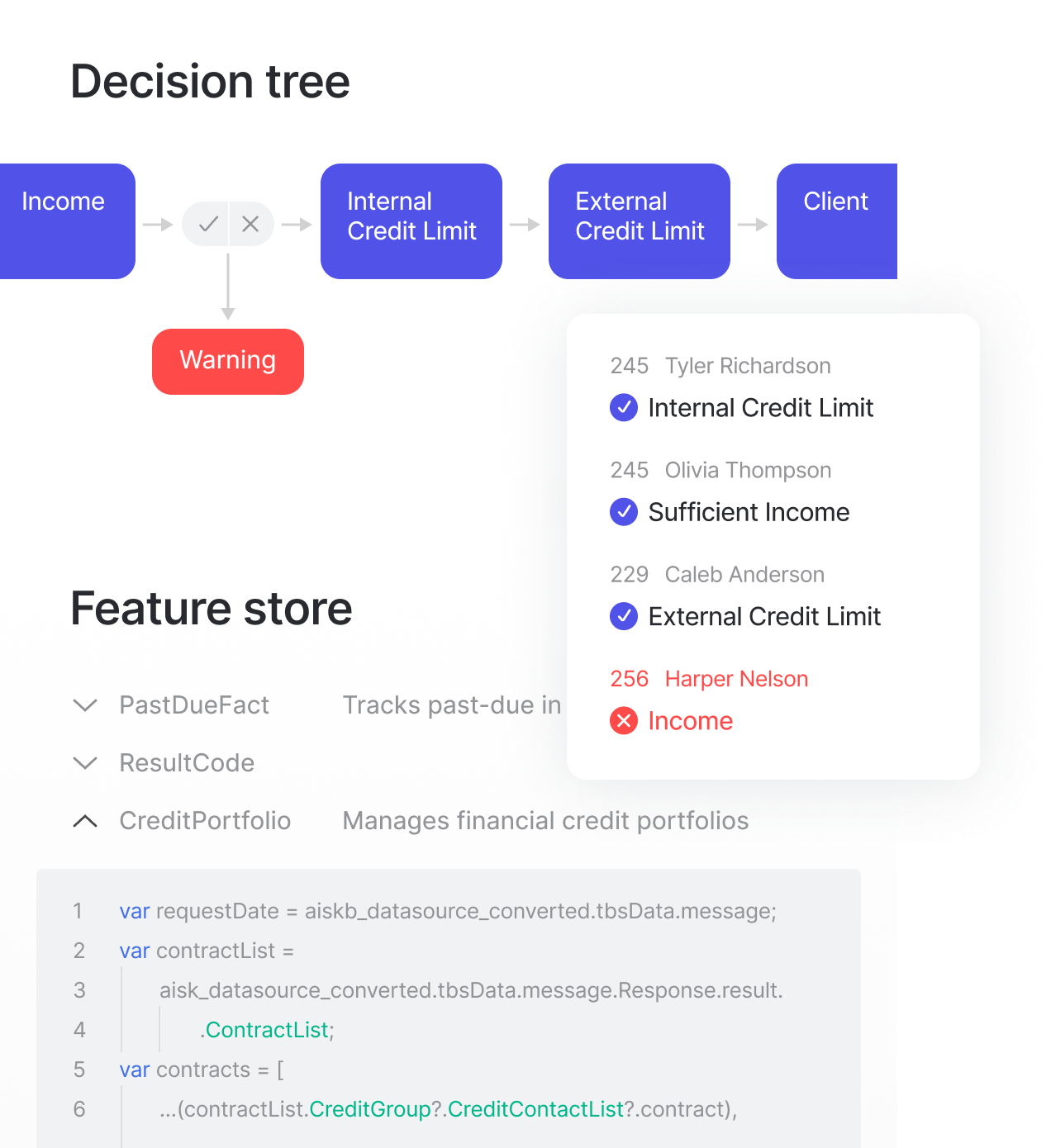

Upon receiving the application, the system performs client underwriting (borrower, lender, or both of them) using available data sources. TIMVERO system for factoring analyzes and matches shipping documents between parties and calculates possible financing amounts, discounts, and lending terms.

After selecting the appropriate conditions, timveroOS automatically generates a contract ready for electronic signature.

After reaching an agreement, timveroOS performs the initial payment and controls payment due dates to inform both lenders and borrowers about upcoming payments.

On the due date, timveroOS may automatically initiate a payment or accrue a late fee in case the payment was not received. The received payments may be distributed between factor and lender depending on the factoring type.

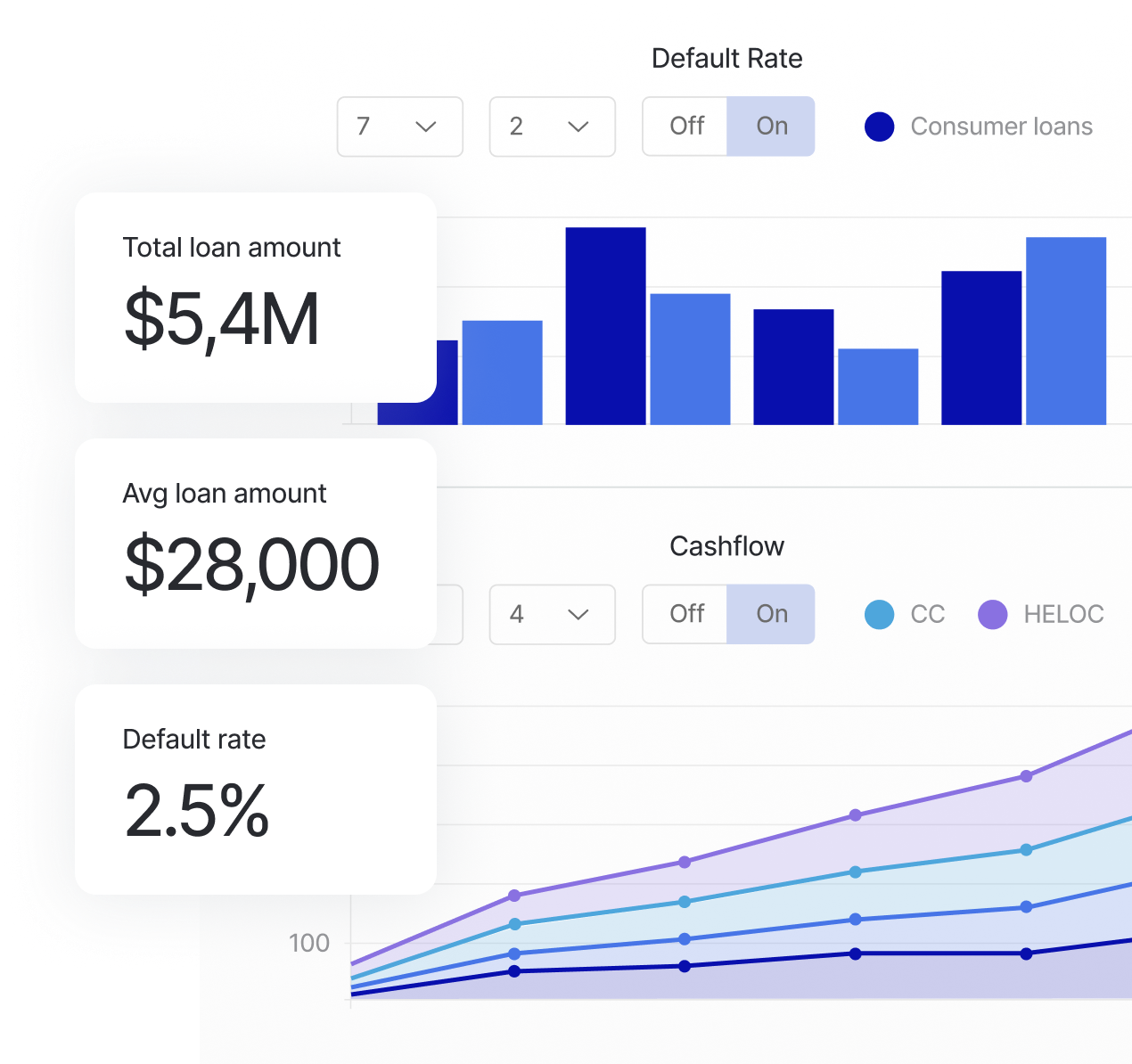

Along with servicing every factoring process and transaction, timveroOS monitors indicators and metrics. In the reporting section, you get real-time access to graphs and tables on applications, loan origination, credit portfolio, past due and defaulted loans, credit product indicators, and more.

Just as well, timveroOS provides information about issued loans and their current conditions to credit bureaus and other data sources.