timveroOS builds seamless and tech-savvy onboarding for banks and financial institutions to improve conversion rates and minimize customer churn at every stage. Your borrowers can undergo fast fully digital KYC checks and submit their consents with a click.

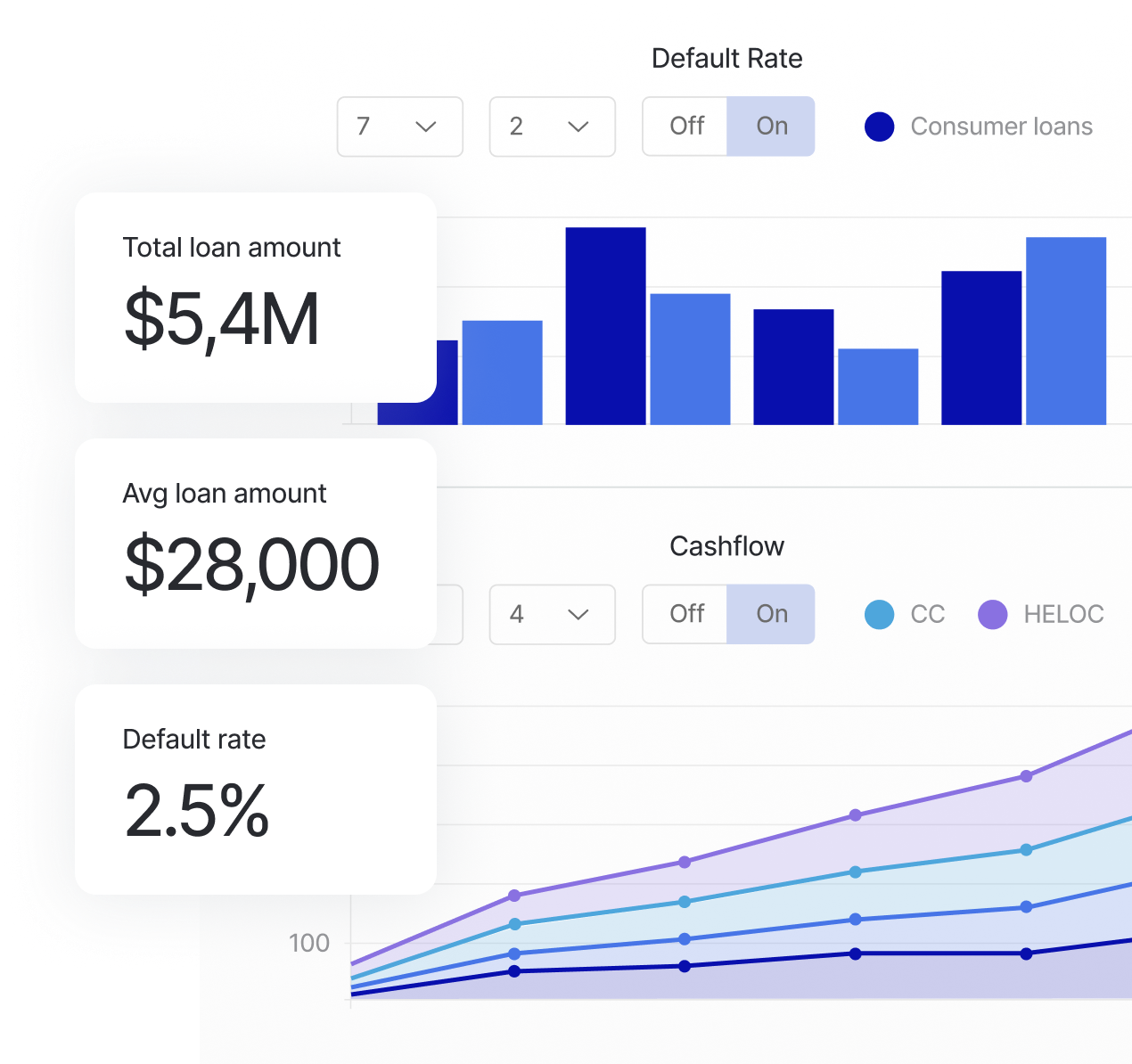

The major advantage of TIMVERO consumer lending software is robust data furnishing tools and analytics.

The system generates forms and supports auto-fill based on existing CRM data or API integrations with data providers. Just as well it easily extracts and processes data from complex financial reports in banks.

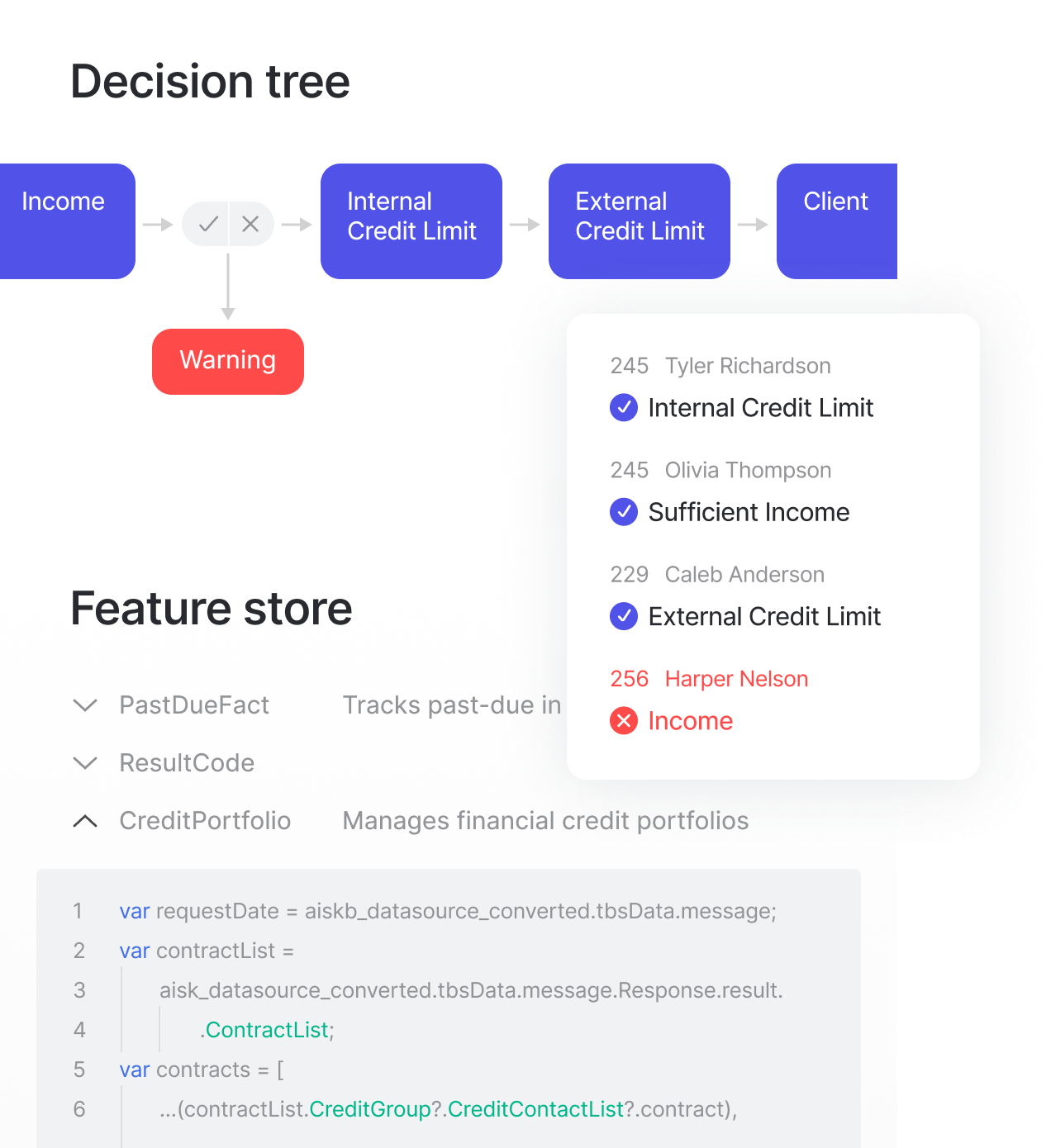

Automated doesn’t mean uncontrollable or black-box.

It is you who defines custom scoring parameters, such as customer profile values, free cash flow range, and other risk parameters.

As a result, your consumer lending business obtains data-centric and effective scoring models - both soft-check and hard-check. Each is based on clear predefined rules for different borrower groups to minimize risk, reduce operating expenses and get the most out of what timveroOS automation can fuel your business with.

The entire document management part can become paperless.

The multi-stage process of signing a contract is supported by a number of online and offline channels. The system stores, edits, and updates various contract templates for borrowers.

The timveroOS functionality includes an automatic opening for debit or credit accounts or loan disbursements via integration with a core/general ledger collateral management. No need to switch between files, folders, and data providers: consumer loan software by TIMVERO unites all contracting operations in a single interface.

Robust collection module is a must-have for retail lending software. When compared to any out-of-the-box solutions in the market, at TIMVERO we added extended covenant control and collecting payments tracking along with ready-made proactive collection strategies for banking with automated notifications.

What’s more: banks and lending businesses always have necessary business metrics at their fingertips due to in-built systems for capturing analytical data and smart reporting.