Experience smooth loan origination in the auto lending industry: timveroOS Vendor Portal enables effortless origination directly from the showroom, enhancing efficiency and reducing processing time.

Auto lenders benefit from detailed document and collateral settings tailored to the industry requirements, ensuring compliance and accurate loan management.

With integrations in place, we provide a steady information flow between systems, which enables fast funds disbursements to the vendor, streamlining the financing process and enhancing customer satisfaction.

Efficiently manage loan servicing in the auto lending industry with timveroOS. Benefit from comprehensive loan monitoring features, including real-time tracking of Loan-to-Value (LTV) ratios, insurance coverage, and other vital factors.

Our auto loan origination software ensures proactive risk management and compliance, allowing you to mitigate potential issues and optimize loan performance.

With automated alerts and robust analytics, you can streamline loan servicing operations and provide exceptional customer service, building warm long-lasting relations with customers.

Reveal the power of auto loan servicing software for debt collection: speed up the process through automated reminders, tailored repayment plans, and 360-degree monitoring.

Use advanced analytics to detect and manage delinquent accounts and improve recovery strategies, moving debt collection efficiency to the next level.

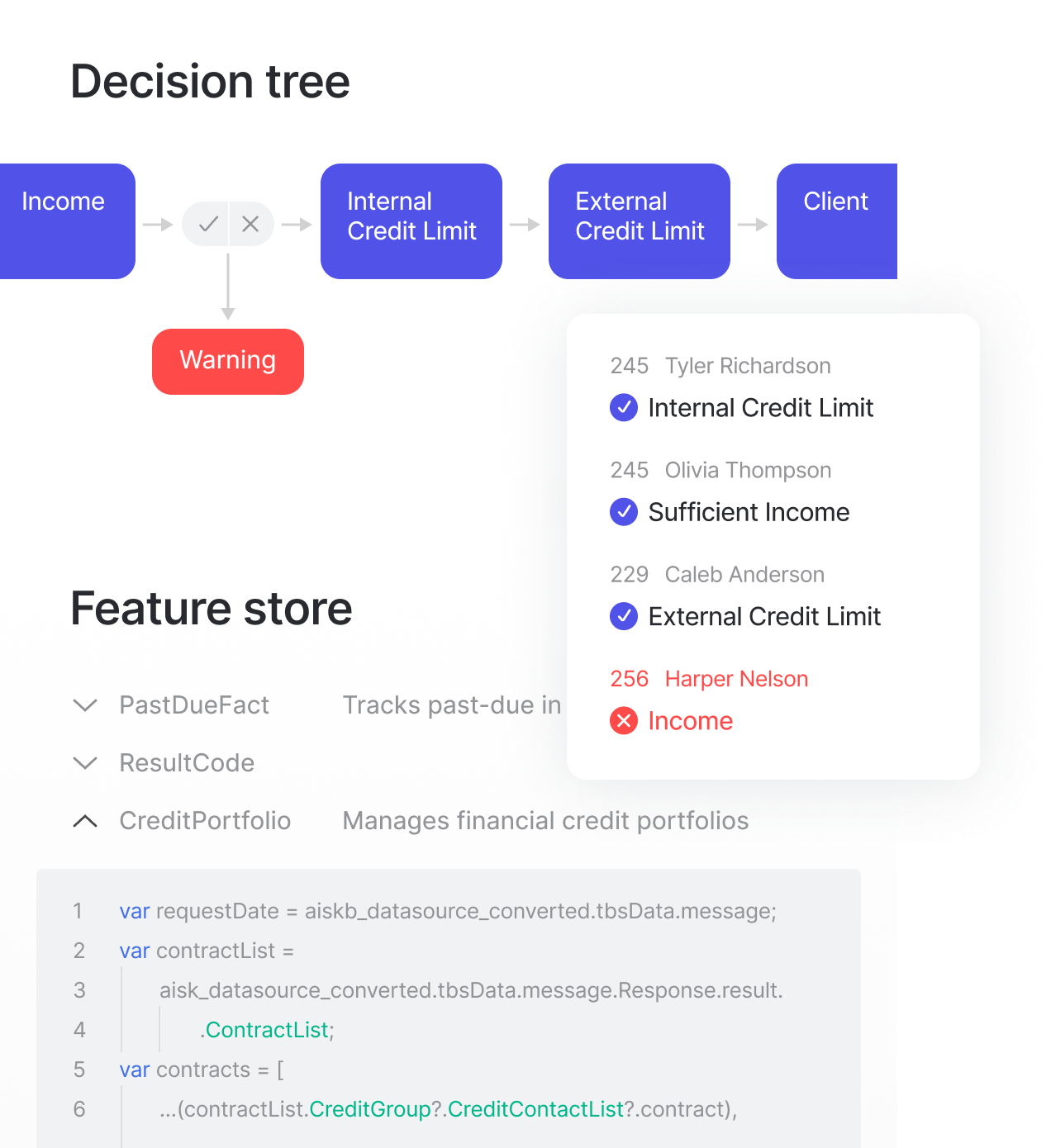

timveroOS analytics module provides valuable insights for informed decision-making of business executives.

By analyzing borrower data, market trends, and risk indicators, you can optimize underwriting processes, detect potential fraud, and make data-driven loan decisions.

Analytics also enables portfolio performance tracking, helping lenders identify areas for improvement and implement effective strategies for risk management and profitability.