Advanced AI analytics

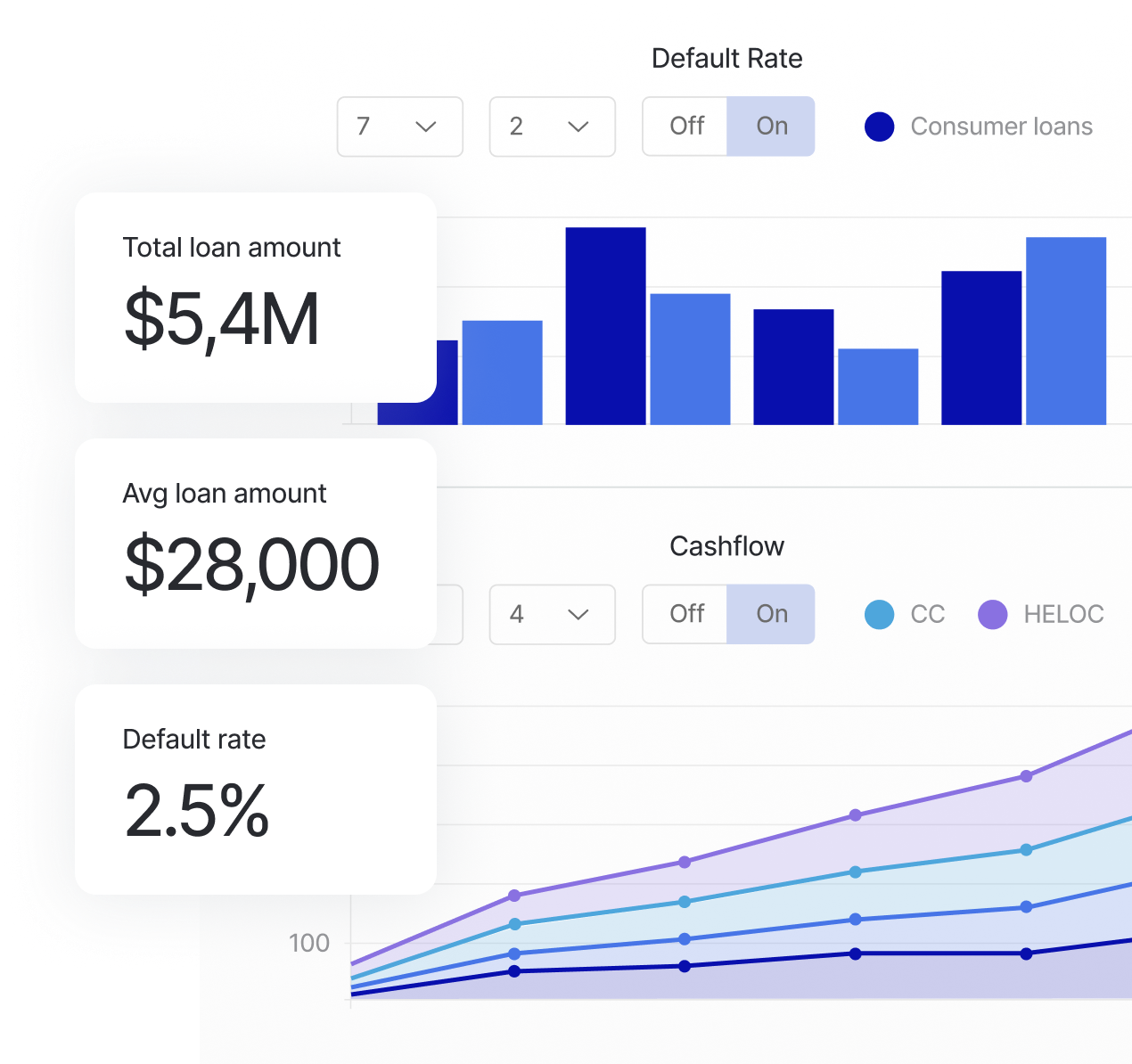

Support your installment lending business with timveroOS Analytics functionality. Leverage AI/ML-based data processing to identify high-performing products and customer segments, optimizing approval rates and minimizing delinquency, all while maintaining efficient staffing levels. The TIMVERO Cashflow Engine provides executives access to powerful financial models, elevating profit per loan. Detailed reports on loan performance and borrower metrics enable trend identification and lending strategy optimization.

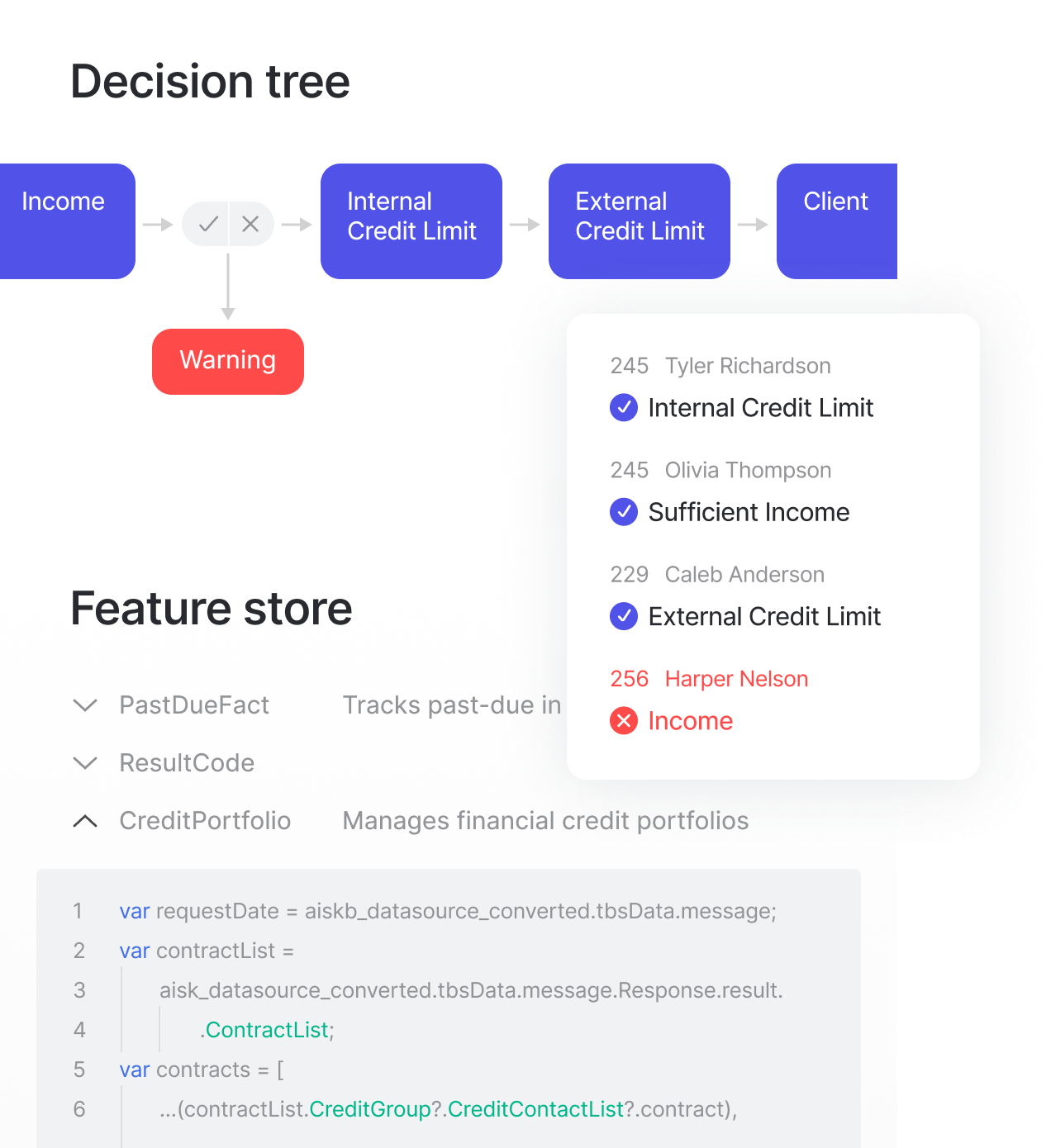

The AI/ML-powered decision-making and reporting module in timveroOS accelerates executive decision-making by up to 12 times, resulting in an average 13% increase in profit per loan for banks and fintechs. This innovative module utilizes data analytics to continuously enhance underwriting, improve services, and drive product development.