What are we discussing here?

The buzz around Section 1033’s proposed regulation is gaining momentum, and every financial institution is trying to find its bearings. But how does this intertwine with modern data solutions, particularly timveroOS? Let’s dissect the core components of this proposal and the consequent value banks can extract with the right systems in place.

What is the Section 1033 Proposal?

The Consumer Financial Protection Bureau (CFPB) has been proactive in putting forth the Personal Financial Data Rights rule. At its essence:

- Objective: A vision for open banking, ensuring consumers wield the control over their financial data, coupled with fortified measures against potential data misuse.

- Historical Context: This isn’t a spontaneous decision. It’s the awakening of a dormant Congressional provision that’s over a decade old.

- Main Features: From ensuring financial institutions don’t become data gatekeepers, to empowering consumers to freely switch their service providers; from guaranteeing free access to personal financial data via secure mediums to setting stringent measures against unchecked data surveillance. It’s an all-encompassing roadmap.

- Implementation Blueprint: This isn’t an overnight transformation. Larger entities will be at the frontline, with smaller ones following suit. However, specific entities like community banks, especially those devoid of digital interfaces, are exempt.

- The Path Ahead: As a part of the broader Consumer Financial Protection Act, Section 1033 is just the beginning. Expect more layers to be added to this regulatory framework in due course.

- Feedback Channel: The proposal is still malleable, with the doors open for public feedback till December 29, 2023.

For those seeking a deep dive, several resources are at disposal, including the official text of section 1033, the Notice of Proposed Rulemaking, and key remarks from the CFPB Director.

The timveroOS Advantage

Now, integrating a complex proposal into practical, on-ground operations is challenging. This is where timveroOS comes into play (I’m also adding link to the other blogs, where we’ve decomposed a specific point)

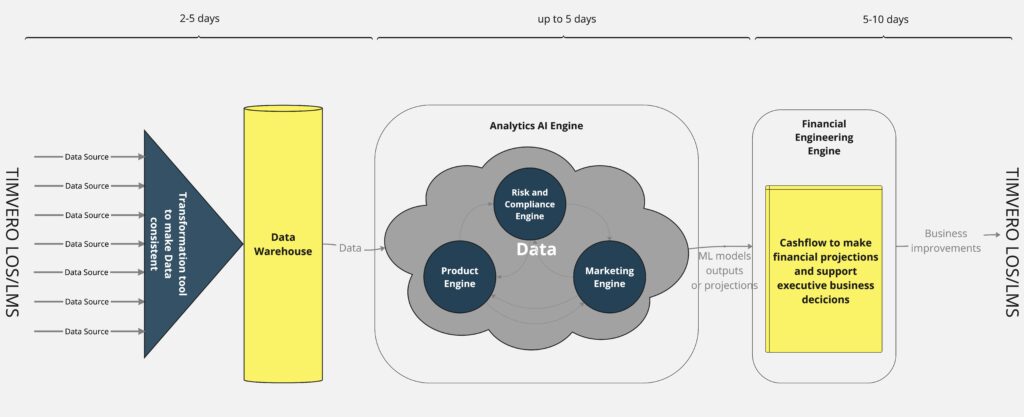

- Efficient Data Management: Connect, ingest, and collect data seamlessly. Know more.

- Holistic Data Sets Creation: Based on consistent, reliable data. Dive deeper into the nuances here and here.

- Risk Teams’ Empowerment: Understand the data implications and explore innovative model testing paradigms. Discover more.

- Business Impact Analysis: Harness the vast data streams and forecast their business implications effectively. Learn about the potential.

- Hyper-Customization: Craft products and processes tailored explicitly around customers’ unique requirements

Banking on timveroOS: The Tangible Gains

With the right systems, banks can unlock unprecedented value:

- Envision a 10-20% surge in profits driven by swifter analytical iterations and data-informed executive decisions.

- Witness a threefold boost in customer loyalty, all credited to a keen understanding of customer needs and the tools to actualize products around them.

- Achieve market supremacy by deciphering market trends 12 times faster than competitors, ensuring you always have the upper hand.

In a rapidly evolving financial landscape, staying ahead requires more than just compliance. With platforms like timveroOS, banks can not only adapt but thrive, ensuring they remain the ship’s captain, steering towards prosperous horizons.