Private credit has emerged as a premier investment avenue on Wall Street, buoyed by several key factors. Let’s start with figures: this asset class raised from $250 billion in 2010 to around $1.5 trillion in early 2024.

What’s more: according to BlackRock, Private Debt Will Double to $3.5 Trillion by 2028.

What stands behind this growth?

With low interest rates and market volatility, investors seek higher yields and stable returns, making private credit an attractive option. Additionally, regulatory changes post-2008 financial crisis tightened lending standards for banks, creating opportunities for private credit firms to fill the lending gap. Moreover, the flexibility of private credit structures allows for tailored financing solutions, appealing to borrowers seeking alternatives to traditional bank loans.

As a result, private credit has soared in popularity, reshaping the investment landscape and diversifying portfolios with lucrative opportunities outside conventional markets.

Financial businesses and their attention to private credit in 2024

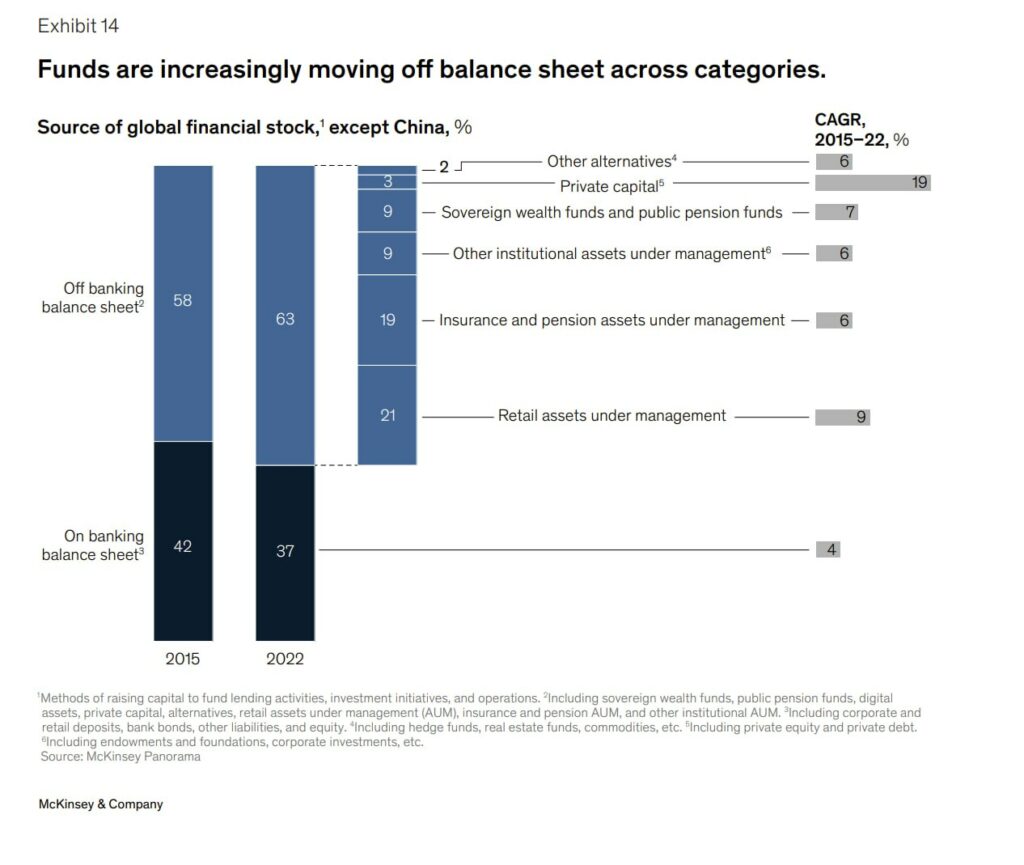

McKinsey and Company provided a breakdown for this rapid growth to the $1.5 trillion we mentioned at the start.

The private capital market, comprising both private debt and private equity, has experienced significant growth despite its relatively small size, accounting for about 3 percent of the total market.

Between 2015 and 2022, it expanded rapidly at an average annual rate of nearly 20 percent. North America leads the market, followed by Asia. Retail assets under management, constituting 21 percent of total funds, have also shown robust growth, averaging 9 percent annually since 2015.

Both private debt and private equity have seen accelerating annual growth rates. Private debt, in particular, witnessed its highest inflows in 2022, with a remarkable 29 percent growth rate.

Will alternative lending capital be migrating to private credit?

Difficult to predict, however, to provide some overview:

Private credit offers tailored lending solutions outside traditional banking channels. Today it involves non-bank entities, including alternative lending organizations and private credit firms, extend credit to businesses or individuals.

While alternative lending focuses on various lending forms, private credit organizations specialize in structured financing for businesses, often with higher flexibility and risk-adjusted returns.

The key difference between private lenders and alternative lenders lies in their approach to lending and eligibility criteria. Private lenders primarily focus on home equity, with higher risk tolerance and less emphasis on income or credit score. In contrast, alternative lenders have stricter guidelines, including debt service ratios, but may offer more flexibility compared to traditional banks in terms of lending requirements and financing options.

In 2024, private credit may be an option due to the combination of attractive returns, portfolio diversification, flexibility, and tailored solutions. All that makes private credit an appealing option for both investors and borrowers in today’s financial landscape.

Successful start: what FIs need to have to start a private credit business?

To embark on a successful private credit venture, financial institutions (FIs) must establish a robust foundation and infrastructure. We’d focused on the following elements lending institutions need to have to initiate a private credit business:

Capital adequacy

Adequate capital is essential to support lending activities and absorb potential losses. FIs must have a strong analytical backbone to calculate sufficient capital reserves to comply with regulatory requirements and withstand market fluctuations in 2024.

Regulatory compliance

Compliance with regulatory standards is paramount in the financial industry. FIs must navigate complex regulatory frameworks governing lending practices, including licensing, disclosure, and consumer protection laws.

Here are some key factors:

- Banking Regulations and Capital Requirements:

- Basel III: These international banking standards impact capital adequacy, risk management, and liquidity. Stricter capital requirements may affect banks’ lending capacity and encourage them to partner with private credit providers.

- Dodd-Frank Wall Street Reform and Consumer Protection Act: This U.S. legislation aims to prevent another financial crisis. It affects banks’ lending practices, risk-taking, and transparency, indirectly impacting private credit markets.

- Securities Regulations:

- Securities and Exchange Commission (SEC) rules impact private credit funds that issue securities or operate as investment advisers.

- Investment Company Act of 1940: Governs investment companies, including business development companies (BDCs) that invest in private credit

- Anti-Money Laundering (AML) and Know Your Customer (KYC):

- Stringent AML and KYC requirements impact private credit funds’ operations and due diligence processes.

Risk Management Framework and credit underwriting experience

FIs must implement rigorous credit risk assessment processes, stress testing, and portfolio monitoring mechanisms to safeguard against default and credit losses. Along with that, sound credit underwriting practices are essential to evaluate borrower creditworthiness and assess the likelihood of repayment. FIs need to hire skilled underwriters or invest in feature-rich AI-based software with expertise in analyzing financial statements, assessing collateral, and evaluating borrower credit profiles.

Technology Infrastructure

In addition to AI-powered analytics for risk management and financial predictions, a robust technology infrastructure is critical to support loan origination, underwriting, servicing, and portfolio management functions. FIs require integrated software solutions, data analytics tools, and automation capabilities to streamline operations and enhance efficiency.

The platform needs to include loan servicing tools as well to manage borrower relationships, process loan payments, and handle delinquencies or defaults. FIs must have dedicated servicing teams equipped to handle borrower inquiries, manage escrow accounts, and ensure compliance with loan terms.

Investor Relations

Financial organizations need to cultivate transparent communication channels, provide timely reporting, and demonstrate sound financial performance to instill investor confidence.

Scalability Plan

A scalability plan involves assessing market opportunities, diversifying loan portfolios, and optimizing operational processes to support increased lending volumes.

Most of these key elements can be addressed with a proper software platform acting as a backbone for the private credit business.

TIMVERO lending system assists in laying the groundwork for a successful private credit business, product positioning, risk management, handling business processing, and delivering value to borrowers and investors alike.

Why timveroOS?

timveroOS encompasses several key features and capabilities tailored to the unique needs of the private credit industry:

- Loan Origination: streamlined processes for originating loans, including application intake, credit underwriting, and approval workflows.

- Portfolio Management: comprehensive tools for managing loan portfolios, including tracking borrower information, loan terms, payment schedules, and performance metrics.

- AI-powered Risk Assessment: advanced analytics and risk modeling capabilities to assess borrower creditworthiness, identify potential risks, and optimize lending decisions.

- Document Management: secure document storage and management functionalities to centralize loan documentation, contracts, and other critical paperwork.

- Investor Reporting: automated reporting tools to generate and distribute investor reports, providing transparency and accountability to stakeholders.

- Integration Capabilities: seamless integration with third-party systems and services, such as credit bureaus, payment processors, and accounting software, to streamline operations and enhance efficiency.

- Scalability and Flexibility: scalable architecture and customizable configurations to accommodate growth and adapt to evolving business needs over time.

- Data Security: Robust security measures to protect sensitive borrower and investor data, including encryption, access controls, and regular security audits.

- User Experience: Intuitive user interface and user-friendly features to enhance usability and productivity for employees across various departments.

timveroOS stands out as the premier software platform for both established and emerging private credit enterprises. Its unparalleled functionality, coupled with Explainable AI (XAI) Analytics, empowers users with insightful and transparent data-driven decision-making capabilities. Additionally, the advanced Financial Engineering/Cashflow engine ensures optimal performance, making TimveroOS the ultimate choice for driving success in the private credit industry.

Book a personalized 30-minute demo to learn more about TIMVERO’s software for private credit.