AI Loan Portfolio Analytics

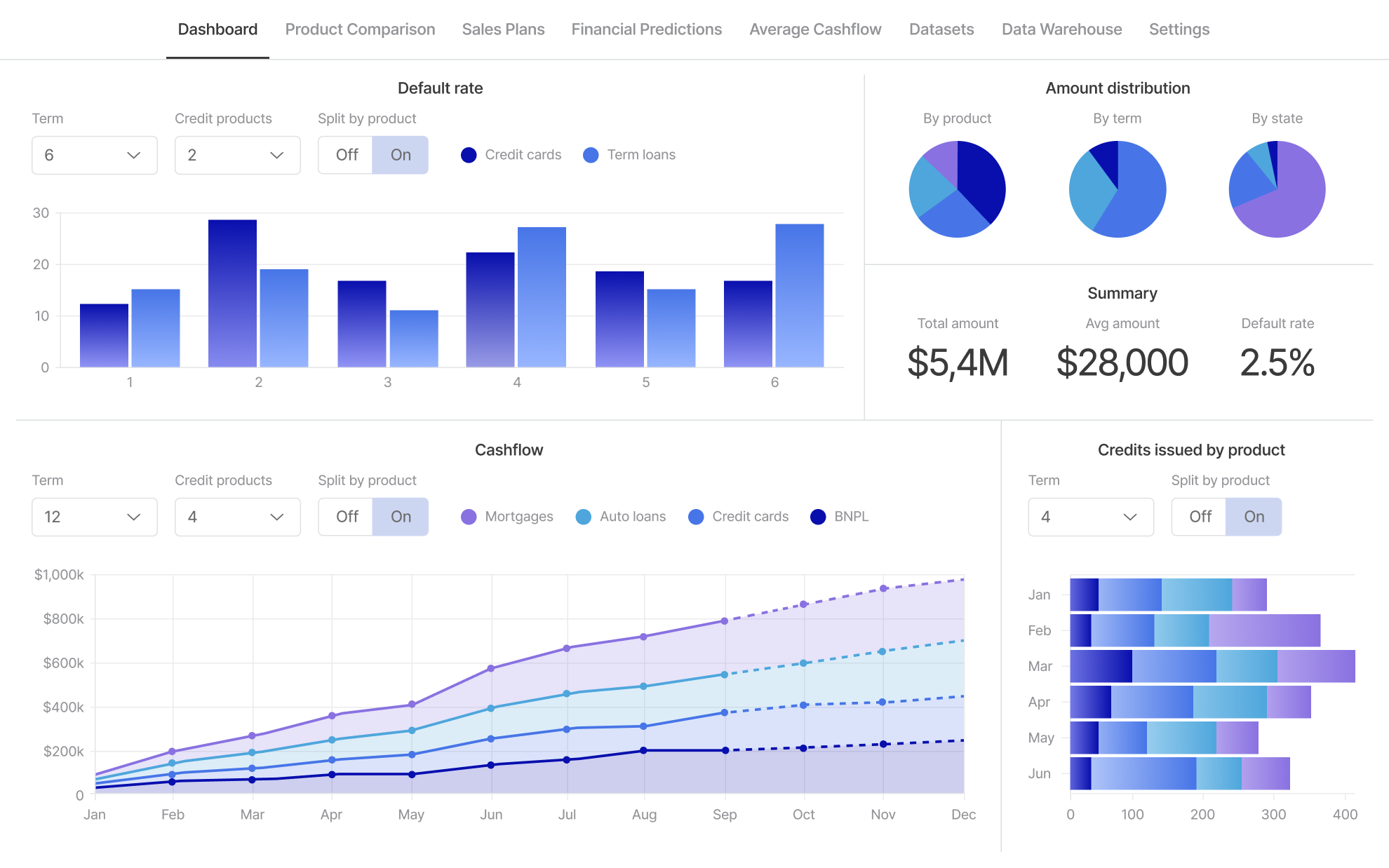

Analytics AI Engine leverages data from various sources to generate valuable insights that improve underwriting, service, and product enhancement. The Financial Engineering/Cashflow engine evaluates the prospective business repercussions of these recommendations and assists stakeholders in making informed, data-driven executive decisions.

12x faster executive decisions

Make ML-powered strategical executive decisions up to twelve times faster due to obtaining qualitative and quantitative data at your fingertips due to frictionless automation in several steps: XAI engine collects data, while the Financial Engineering/Cashflow engine turns it into insights and doable recommendations.

Value loop covering LOS and LMS in full

The interconnected operating system encompasses the entire workflow covering loan origination, loan management, and debt collection in full. Due to the SDK, any innovations can be implemented faster in the two layers of analytics: ML for model building and Financial Engineering tools for projecting the business impact of innovations.

Real-time Fin. engineering

Financial company executives and stakeholders get an opportunity to realistically simulate the implementation of various strategies, such as new loan products, adjusted lending terms, customizable offers for various customer segments, risk modeling, or collection strategies. The simulator is created for loan portfolio analysis of each scenario.

ML for reliable risk prediction

The platform enables executives and product stakeholders to project new ideas or future macro-/microeconomical events on the current loan portfolio to estimate risks and make decisions based on the company’s financial health and risk appetite.

Integration of multiple data sources

The seamless connection of an extensive data warehouse that gathers internal and external data sources to the powerful ML-based analytics module (SageMaker) provides a limitless area for experiments, A/B tests, and data-first decisioning in a user-friendly neat interface.

In-built collaboration projection tools

timveroOS grants space for risk, marketing, and product teams to test new ideas, fortify each other’s performance, and gain new insights for loan portfolio analysis up to 10 times faster. The ML tool used helps to store results at the analytics DWH for future references and statistics comparison.

12x faster executive decisions

Make ML-powered strategical executive decisions up to twelve times faster due to obtaining qualitative and quantitative data at your fingertips due to frictionless automation in several steps: XAI engine collects data, while the Financial Engineering/Cashflow engine turns it into insights and doable recommendations.

Value loop covering LOS and LMS in full

The interconnected operating system encompasses the entire workflow covering loan origination, loan management, and debt collection in full. Due to the SDK, any innovations can be implemented faster in the two layers of analytics: ML for model building and Financial Engineering tools for projecting the business impact of innovations.

Real-time Financial engineering

Financial company executives and stakeholders get an opportunity to realistically simulate the implementation of various strategies, such as new loan products, adjusted lending terms, customizable offers for various customer segments, risk modeling, or collection strategies. The simulator is created for loan portfolio analysis of each scenario.

ML for reliable risk prediction

The platform enables executives and product stakeholders to project new ideas or future macro-/microeconomical events on the current loan portfolio to estimate risks and make decisions based on the company’s financial health and risk appetite.

Integration of multiple data sources

The seamless connection of an extensive data warehouse that gathers internal and external data sources to the powerful ML-based analytics module (SageMaker) provides a limitless area for experiments, A/B tests, and data-first decisioning in a user-friendly neat interface.

In-built collaboration projection tools

timveroOS grants space for risk, marketing, and product teams to test new ideas, fortify each other’s performance, and gain new insights for loan portfolio analysis up to 10 times faster. The ML tool used helps to store results at the analytics DWH for future references and statistics comparison.

AI loan portfolio analytics

Loan Portfolio Analytics in timveroOS is a great comprehensive solution for the digital transformation of financial institutions. Integration of multiple data sources and ML-based analytics provide limitless experimentation and data-first effective decision-making based on projections and experiments.

All the data is systematically preserved in the Data Warehouse in a tabular and consistent format, significantly enhancing the efficiency of analytics.

The Analytics AI Engine leverages data-intensive storage to uncover findings for continuous underwriting, service enhancements, or product developments. This could include updates to underwriting models, risk modeling for specific customer segments, the introduction of new loan products, or modifications to terms and conditions.

Financial engineering

timveroOS offers a suite of financial engineering tools that are designed to empower your decision-making process. With reliable risk prediction capabilities and real-time event simulation, our platform paves the way for executive decisions that are up to 12x faster and can elevate profits by 20%.

Our Financial Engineering/Cashflow engine stands out by allowing gaming simulations, “what-if” scenarios, and various financial projection methodologies. More than just giving advice, timveroOS evaluates the potential business outcomes of these recommendations, aiding stakeholders in making informed, data-driven executive decisions.

Become truly agile with our Loan Portfolio Analytics framework. Project the impact of these ideas, seamlessly integrate them into production, test, and scale — all within a matter of days, not months. Beyond just speed, our framework ensures alignment among all stakeholders.

Our customers

Get a demo

Learn more about the way TIMVERO can revolutionize your loan portfolio management with robust AI analytics and extensive automation.

Leave your contacts to get a personalized 30-min demo.