Fintech Lending Software

Fintechs and alternative lending organizations require outstanding software scalability, rich functionality for business insights and analytics, and the opportunity to launch new loan products in a blink of an eye.

All of that combined with attractive end-user functionality makes timveroOS for lending a great choice for fintechs.

Comprehensive CRM

system

Consistent and functional proprietary CRM in TIMVERO lending system for fintechs includes DWH for rich analytics used in decision-making and process orchestration.

AI-first operating model

Reveal the full potential of AI-based data modules for your lending business. It manages automated data extraction, processing, and demonstration in a user-friendly interface. Optimize your loan portfolio performance and expand revue streams.

Vendor and client portal

Seamless integration of the customer-facing part with a robust back office provides end-to-end coverage of loan management processes in fintechs and alternative lending organizations. The system is fully customizable due to SDK-based engineering.

Multichannel loan

application

Give your borrowers a choice for better flexibility and a higher retention rate: enable borrowers to apply via the mobile, web, vendor portal, or customer portal. All the requests are stored in a single place to assist loan officers and underwriters and automate their routine.

Document management

tools

timveroOS got lending companies covered in document management: it stores templates and ready documents prepares them for sending and tracks them on the way. Be it loan applications, consents, offers, or contracts.

Collection tools

A lot of vendors may offer robust loan management, but few of them provide full-fledged collection functionality. TIMVERO technically supports the deals end-to-end, including delinquency management, soft and legal collection, and backs it up with analytics.

Comprehensive CRM system

Consistent and functional proprietary CRM in TIMVERO lending system for fintechs includes DWH for rich analytics used in decision-making and process orchestration.

AI-first operating model

Reveal the full potential of AI-based data modules for your lending business. It manages automated data extraction, processing, and demonstration in a user-friendly interface. Optimize your loan portfolio performance and expand revue streams.

Vendor and client portal

Seamless integration of the customer-facing part with a robust back office provides end-to-end coverage of loan management processes in fintechs and alternative lending organizations. The system is fully customizable due to SDK-based engineering.

Multichannel loan application

Give your borrowers a choice for better flexibility and a higher retention rate: enable borrowers to apply via the mobile, web, vendor portal, or customer portal. All the requests are stored in a single place to assist loan officers and underwriters and automate their routine.

Document management tools

timveroOS got lending companies covered in document management: it stores templates and ready documents prepares them for sending and tracks them on the way. Be it loan applications, consents, offers, or contracts.

Collection tools

A lot of vendors may offer robust loan management, but few of them provide full-fledged collection functionality. TIMVERO technically supports the deals end-to-end, including delinquency management, soft and legal collection, and backs it up with analytics.

Lending software for fintechs:

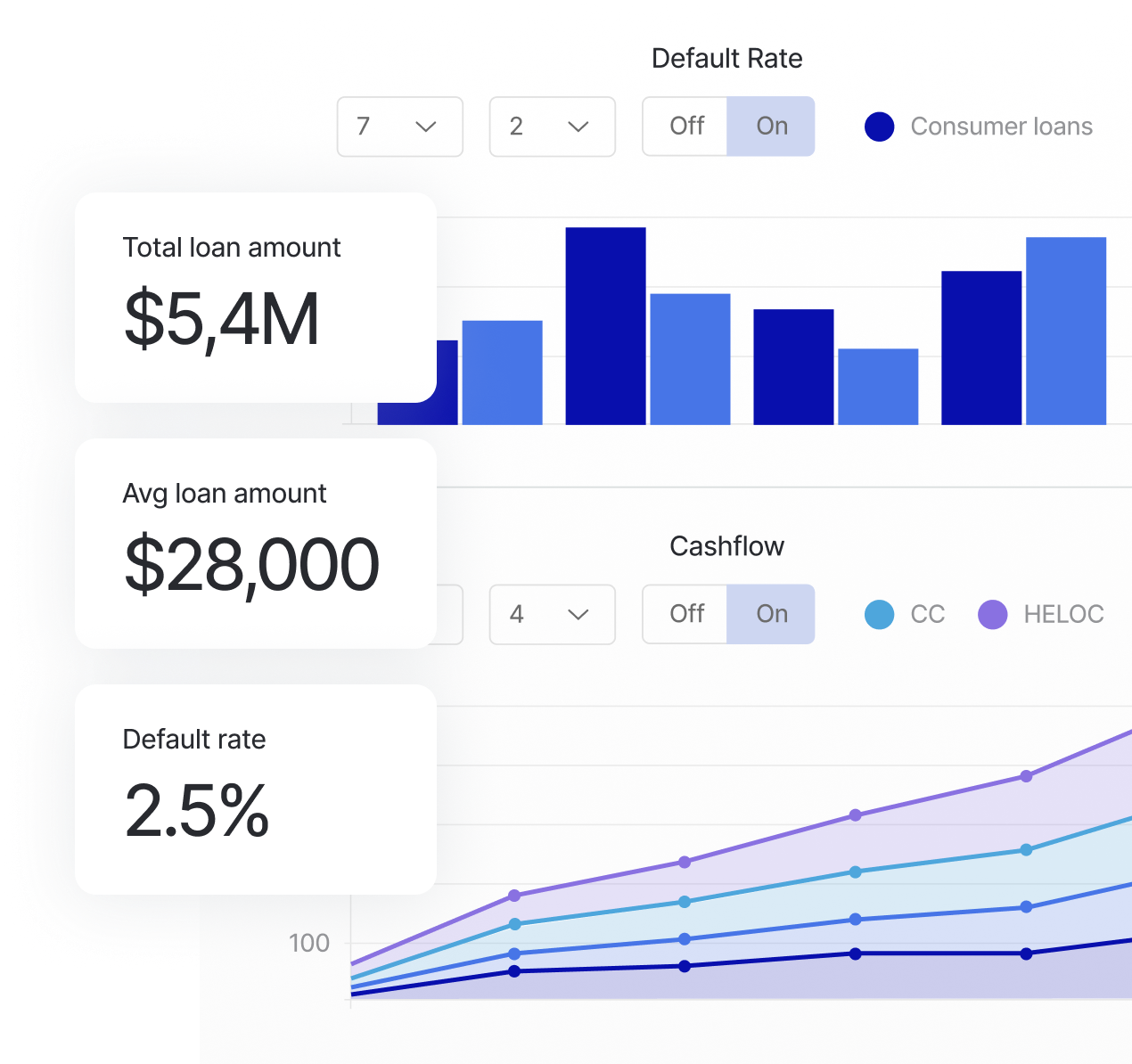

AI analytics

Lending software for fintechs: AI analytics

TIMVERO created the XAI-first (XAI – explainable AI) approach in lending software development for fintechs and alternative lenders.

Easy implementation of AI-refined data is the key: each team on each level received insights for data-first decision-making. Our customers make strategic decisions up to 12 times faster.

How it works:

TIMVERO delivers an easy-to-use AI/ML-powered analytics module to your loan management platform.

The data transformation modules work with data from customer actions, transactions, or communications and generate genuine recommendations with this data. For example, suggestions on process improvements, collection approaches, loan product ideas, and more.

Due to that, your fintech company can gain a tangible competitive advantage in lending by estimating the expected business impact of every single decision or action. No coding or data analytics skills are required.

TIMVERO delivers an easy-to-use AI/ML-powered analytics module to your loan management platform.

The data transformation modules work with data from customer actions, transactions, or communications and generate genuine recommendations with this data. For example, suggestions on process improvements, collection approaches, loan product ideas, and more.

Due to that, your fintech company can gain a tangible competitive advantage in lending by estimating the expected business impact of every single decision or action. No coding or data analytics skills are required.

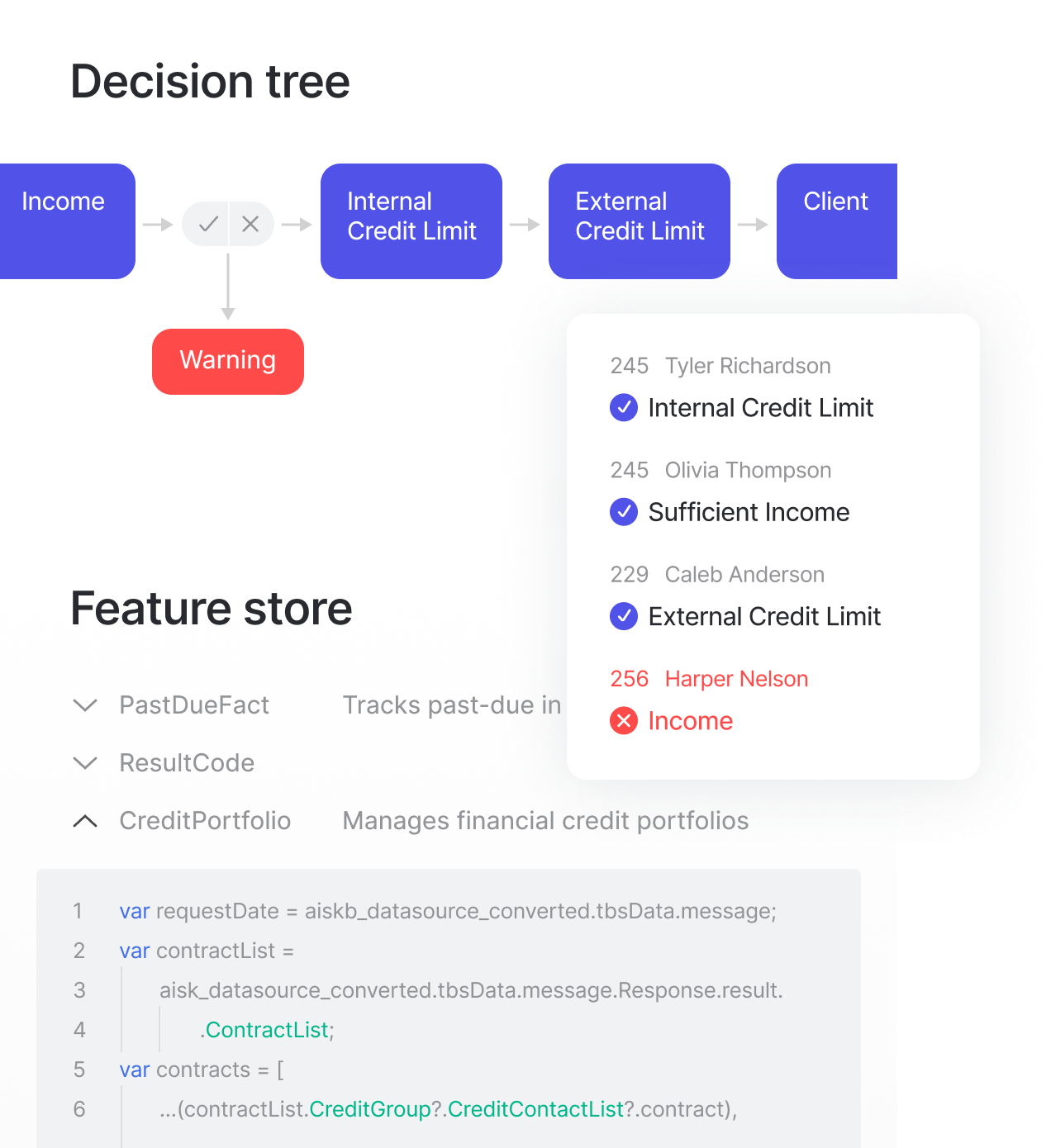

Smart decision-making

Fintechs highly value data-driven scoring and decision-making provided by timveroOS. Here is how it works.

The loan origination module is powered by a customizable underwriting engine paired with an open-source BPM module. The system is integrated with the Machine learning engine, as well as with the cloud DWH module both created and delivered by TIMVERO. It allows you to:

- Work in the no-code environment connecting features from the feature marketplace to necessary nodes, checking, and paths.

- Tailor loan products and loan amounts to the needs of various customer segments

- Personalize the business process of underwriting and make adjustments in minutes.

Your fintech lending business becomes completely digital at its core: powered by analytics and insights that are really used, not just stored.

Customers recommend us

Customers

recommend us

Lending software for banks

We also suggest trying timveroOS for bank lending automation: it can be integrated with the core banking system or built from scratch. Highly flexible modules can fit sets of business processes of any complexity.

Lending software for banks

We also suggest trying timveroOS for bank lending automation: it can be integrated with the core banking system or built from scratch. Highly flexible modules can fit sets of business processes of any complexity.

Want a demo?

We can tell you more at the 30-min live personalized demo. Just leave your contacts in the form, and our team will reach out to demonstrate the full potential of TIMVERO lending software.