Commercial lending software

TIMVERO – one of the leading commercial lending software vendors offers a full-cycle platform for commercial lending automation in banks and FIs: from application all the way through underwriting to disbursement, and even collection.

The OS supports SME and enterprise-level credit products: loans, secured and unsecured credit lines, business credit cards, BNPL/installment lending automation for businesses, and merchant cash advance. Just as well are ready to develop commercial loan origination software for complex factoring, leasing, and brokerage projects in banking.

Commercial lending made

outstanding

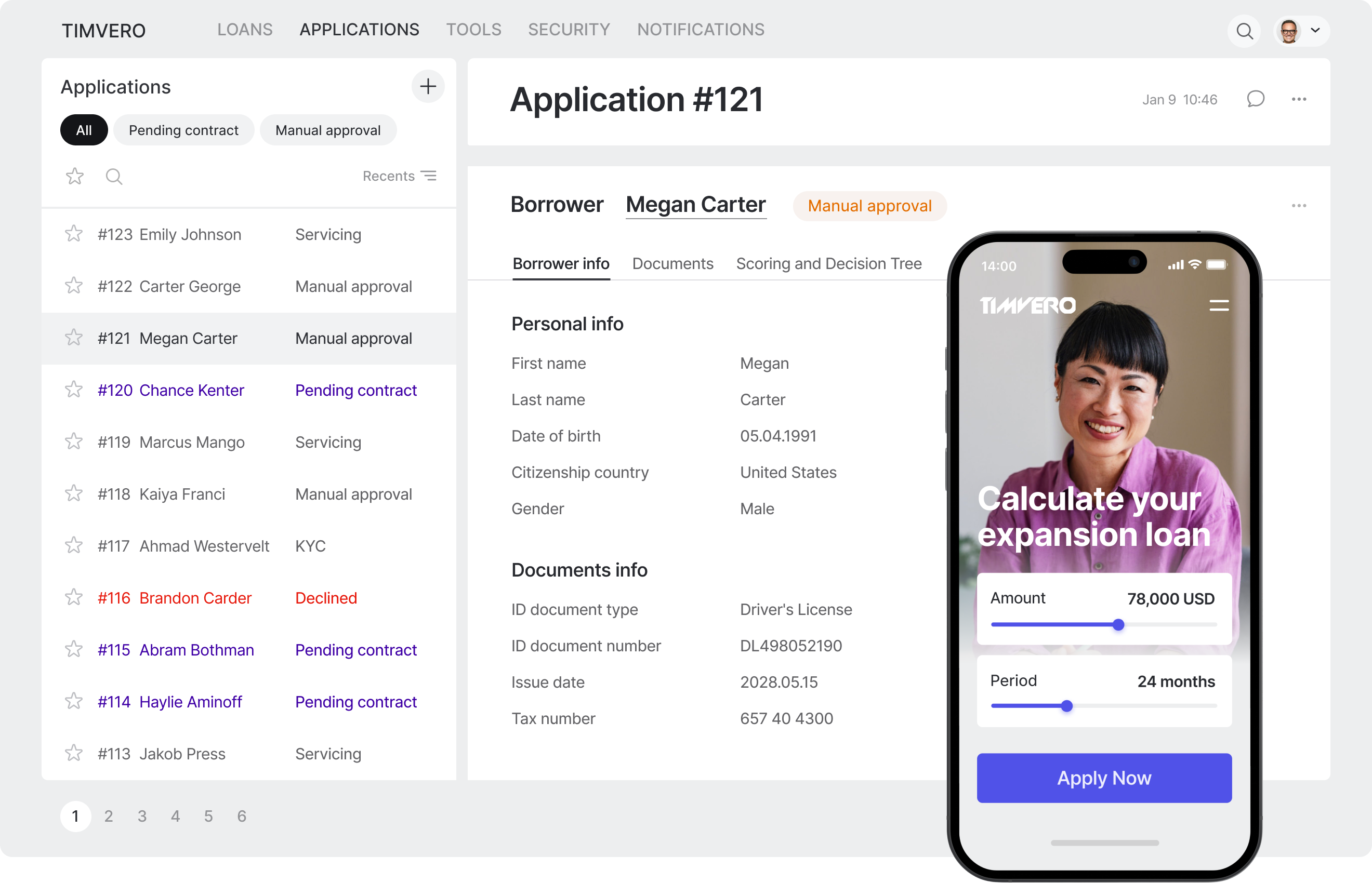

Digital onboarding

timveroOS provides tailor-made and technology-powered user onboarding to win the loyalty of business customers from the first click. For commercial loan origination system we implement automated due diligence and KYB with fast and secure document uploads and submitting consents. At TIMVERO, we focus on furnishing tools and analytics, this is our key strength. The OS allows form auto-fill due to integrations with existing CRM or API integrations with selected data providers. Smoothly and seamlessly, it extracts, processes, and implements huge arrays of data from complex financial reports.

Data-driven scoring

Allow the commercial loan servicing software to build a scoring model for you, be it a soft check or hard check. Due to the user-friendly interface, you can easily get into it to ensure it fully meets your business goals. The scoring models are applicable to entities, founders, and key persons. The models are fully customizable to be worthy of your trust. You can pick any parameters, like business profile values, financial statements, payment history, and any other risk factors based on your historical banking data, and benefit from precise results.

Contracting

We re-design the complex contract signing process in commercial loan underwriting software to make it as simple as possible for commercial lending. The process is supported by various online and offline channels, generating custom templates for business borrowers, including company founders and key persons. With timveroOS you can set debit and credit account creation and loan disbursements performed automatically to save your team’s efforts for really challenging tasks.

Debt collection

Collection is an integral part of commercial loan managementsoftware. In addition to popular ready-made features in the market, loan servicing provided by timveroOS includes covenant monitoring and proactive strategies with predefined actions, such as custom email or SMS notifications. To keep your bank performance metrics transparent and accessible, the system provides full tracking and accounting of collection repayments and gathers analytics for extensive reporting functionality.

Digital onboarding

Data-driven scoring

Contracting

Debt collection

timveroOS provides tailor-made and technology-powered user onboarding to win the loyalty of business customers from the first click. For commercial loan origination system we implement automated due diligence and KYB with fast and secure document uploads and submitting consents. At TIMVERO, we focus on furnishing tools and analytics, this is our key strength. The OS allows form auto-fill due to integrations with existing CRM or API integrations with selected data providers. Smoothly and seamlessly, it extracts, processes, and implements huge arrays of data from complex financial reports.

Allow the commercial loan servicing software to build a scoring model for you, be it a soft check or hard check. Due to the user-friendly interface, you can easily get into it to ensure it fully meets your business goals. The scoring models are applicable to entities, founders, and key persons. The models are fully customizable to be worthy of your trust. You can pick any parameters, like business profile values, financial statements, payment history, and any other risk factors based on your historical banking data, and benefit from precise results.

We re-design the complex contract signing process in commercial loan underwriting software to make it as simple as possible for commercial lending. The process is supported by various online and offline channels, generating custom templates for business borrowers, including company founders and key persons. With timveroOS you can set debit and credit account creation and loan disbursements performed automatically to save your team’s efforts for really challenging tasks.

Collection is an integral part of commercial loan managementsoftware. In addition to popular ready-made features in the market, loan servicing provided by timveroOS includes covenant monitoring and proactive strategies with predefined actions, such as custom email or SMS notifications. To keep your bank performance metrics transparent and accessible, the system provides full tracking and accounting of collection repayments and gathers analytics for extensive reporting functionality.

Commercial lending

made

outstanding

Digital onboarding

timveroOS provides tailor-made and technology-powered user onboarding to win the loyalty of business customers from the first click. For commercial loan origination system we implement automated due diligence and KYB with fast and secure document uploads and submitting consents. At TIMVERO, we focus on furnishing tools and analytics, this is our key strength. The OS allows form auto-fill due to integrations with existing CRM or API integrations with selected data providers. Smoothly and seamlessly, it extracts, processes, and implements huge arrays of data from complex financial reports.

Data-driven scoring

Allow the commercial loan servicing software to build a scoring model for you, be it a soft check or hard check. Due to the user-friendly interface, you can easily get into it to ensure it fully meets your business goals. The scoring models are applicable to entities, founders, and key persons. The models are fully customizable to be worthy of your trust. You can pick any parameters, like business profile values, financial statements, payment history, and any other risk factors based on your historical banking data, and benefit from precise results.

Contracting

We re-design the complex contract signing process in commercial loan underwriting software to make it as simple as possible for commercial lending. The process is supported by various online and offline channels, generating custom templates for business borrowers, including company founders and key persons. With timveroOS you can set debit and credit account creation and loan disbursements performed automatically to save your team’s efforts for really challenging tasks.

Debt collection

Collection is an integral part of commercial loan managementsoftware. In addition to popular ready-made features in the market, loan servicing provided by timveroOS includes covenant monitoring and proactive strategies with predefined actions, such as custom email or SMS notifications. To keep your bank performance metrics transparent and accessible, the system provides full tracking and accounting of collection repayments and gathers analytics for extensive reporting functionality.

Digital onboarding

Data-driven scoring

Contracting

Debt collection

timveroOS provides tailor-made and technology-powered user onboarding to win the loyalty of business customers from the first click. For SME loan software we implement automated due diligence and KYB with fast and secure document uploads and submitting consents. At TIMVERO, we focus on furnishing tools and analytics, this is our key strength. The OS allows form auto-fill due to integrations with existing CRM or API integrations with selected data providers. Smoothly and seamlessly, it extracts, processes, and implements huge arrays of data from complex financial reports.

Allow the SMB lending software to build a scoring model for you, be it a soft check or hard check. Due to the user-friendly interface, you can easily get into it to ensure it fully meets your business goals. The scoring models are applicable to entities, founders, and key persons. The models are fully customizable to be worthy of your trust. You can pick any parameters, like business profile values, financial statements, payment history, and any other risk factors based on your historical banking data, and benefit from precise results.

We re-design the complex contract signing process to make it as simple as possible for commercial lending. The process is supported by various online and offline channels, generating custom templates for business borrowers, including company founders and key persons. With timveroOS you can set debit and credit account creation and loan disbursements performed automatically to save your team’s efforts for really challenging tasks.

Collection is an integral part of SMB loan software. In addition to popular ready-made features in the market, loan servicing provided by timveroOS includes covenant monitoring and proactive strategies with predefined actions, such as custom email or SMS notifications. To keep your bank performance metrics transparent and accessible, the system provides full tracking and accounting of collection repayments and gathers analytics for extensive reporting functionality.

Custom proactive

strategies

Based on advanced financial monitoring tools and covenant control functionality, timveroOS for business lending enables proactive multi-stage strategies for effective SME loan management.

End-to-end automation at low costs

TIMVERO helps digitalize complicated business workflows and offers reduced self-maintenance costs due to the use of SDK.

Precise loan limit

calculation

You are in charge of the appropriate risk level: just set the parameters, and the system will perform the loan limit calculations with respect to total exposures on your behalf.

All-in-one software for any commercial lending type

The system is suitable for term loans, SME credit cards, lease finance, collateral-free loans, factoring, and overdraft loans - we know how to provide a tech back-bone for any type of business lending.

Seamless collateral management

We consider all possible stumble blocks in collateral management, such as serving multiple parties (banks, broker-dealers, funds, insurance companies, or asset managers) and managing documentation.

Proprietary CRM system

Benefit from a consistent CRM system in our SME loan software that includes DWH for advanced analytics to help you build a better customer experience at every stage of the deal.

Custom proactive strategies

Based on advanced financial monitoring tools and covenant control functionality, timveroOS for business lending enables proactive multi-stage strategies for effective SME loan management.

End-to-end automation at low costs

TIMVERO helps digitalize complicated business workflows and offers reduced self-maintenance costs due to the use of SDK.

Precise loan limit calculation

You are in charge of the appropriate risk level: just set the parameters, and the system will perform the loan limit calculations with respect to total exposures on your behalf.

All-in-one software for any commercial lending type

The system is suitable for term loans, SME credit cards, lease finance, collateral-free loans, factoring, and overdraft loans - we know how to provide a tech back-bone for any type of business lending.

Seamless collateral management

We consider all possible stumble blocks in collateral management, such as serving multiple parties (banks, broker-dealers, funds, insurance companies, or asset managers) and managing documentation.

Proprietary CRM system

Benefit from a consistent CRM system in our SME loan software that includes DWH for advanced analytics to help you build a better customer experience at every stage of the deal.

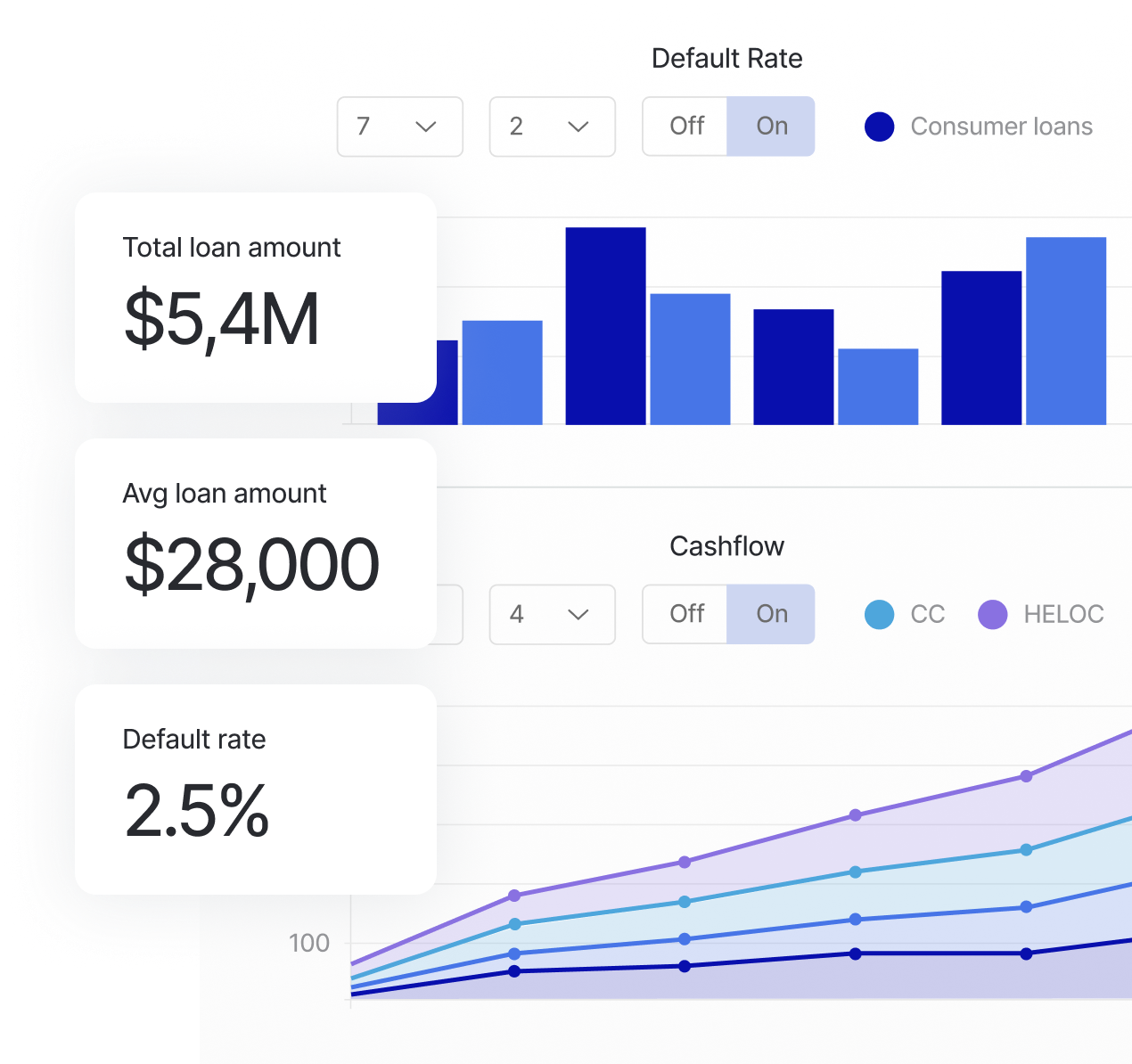

Advanced AI analytics

How we do that:

- Data-driven recommendations and measurable results

- Different risk model types

- Product suggestions

- 12 times faster decision-making

Here’s how the process looks like:

The integration and data transformation modules gather and process data from widely sourced data pools using integrations.

XAI (explainable AI) analytics engine is connected to the data storage to draw the most valuable insights for ongoing underwriting, product improvements, and loan servicing actions.

The cashflow projection module allows measuring the influence of these results in the interconnected financial models across different business departments (such as risk, product, marketing, or finance). It empowers them with data-driven decision-making capabilities.

The integration and data transformation modules gather and process data from widely sourced data pools using integrations.

XAI (explainable AI) analytics engine is connected to the data storage to draw the most valuable insights for ongoing underwriting, product improvements, and loan servicing actions.

The cashflow projection module allows measuring the influence of these results in the interconnected financial models across different business departments (such as risk, product, marketing, or finance). It empowers them with data-driven decision-making capabilities.

Customers say

Solutions for any lending type

Solutions for any

lending type

B2B Installment

POS

MCA

Leasing

Asset-based

Factoing

B2B Installment

POS

MCA

Leasing

Asset-based

Factoring

Automate SME lending with TIMVERO

Apply for a free personalized demo to learn how we can improve business processes in banks and financial institutions and cut operating costs. No fluff or time waste - only highly concentrated facts, examples, a list of features, and detailed pricing.