Bank Lending Software

Digital transformation both in neobanks and incumbent banks requires a strategy and a well-thought-out software solution. TIMVERO has a vast experience in bank lending software development and is able to quickly grasp even the most complicated functional requirements.

The expertise we possess, allows us to build scalable tech-advanced systems with powerful analytics modules and convenient end-user interfaces.

Enable AI-first operating model

Uncover the business value of AI/ML-based data processing for your bank loan software. AI in timveroOS enables smart data extraction, structuring, and running no-code ML experiments on it. The received results help to immediately recalculate cashflow projections, understand the overall business effect, and deploy improvements. Strengthen your loan portfolio and increase the recurring revue.

Modular architecture

TIMVERO builds digital lending systems for banks from scratch or integrates the updated lending solutions with the existing core banking systems. The modular architecture provides scalability, flexibility, and shorter time-to-market, as well as predictable and smoothly planned migration of data.

Vendor and client portal

Digital loan software for banks based on timveroOS includes vendor and client portals for easy onboarding, loan origination, and loan management in banks of any size and business focus. The portal settings are customizable due to the use of SDK.

Comprehensive 360-degree CRM system

A powerful CRM serves as a backbone for bank loan origination software. We deliver consistent and highly adjustable CRM systems to meet the requirements and needs of banks in full. The system includes DWH for valuable analytics.

Credit and debit card processing integrations

Integration with payment providers for automated disbursements and payments along with delinquency management is one of the key functions banks are usually interested in. TIMVERO has a robust list of pre-installed integrations available.

Collection tools

TIMVERO provides automated bank loan management software from A to Z: from digital loan origination to collection: analytics, decision-making, automated notifications, soft and legal collection, automated interest accruals, and more.

Enable AI-first operating model

Uncover the business value of AI/ML-based data processing for your bank loan software. AI in timveroOS enables smart data extraction, structuring, and running no-code ML experiments on it. The received results help to immediately recalculate cashflow projections, understand the overall business effect, and deploy improvements. Strengthen your loan portfolio and increase the recurring revue.

Modular architecture

TIMVERO builds digital lending systems for banks from scratch or integrates the updated lending solutions with the existing core banking systems. The modular architecture provides scalability, flexibility, and shorter time-to-market, as well as predictable and smoothly planned migration of data.

Vendor and client portal

Digital loan software for banks based on timveroOS includes vendor and client portals for easy onboarding, loan origination, and loan management in banks of any size and business focus. The portal settings are customizable due to the use of SDK.

Comprehensive 360-degree CRM system

A powerful CRM serves as a backbone for bank loan origination software. We deliver consistent and highly adjustable CRM systems to meet the requirements and needs of banks in full. The system includes DWH for valuable analytics.

Credit and debit card processing integrations

Integration with payment providers for automated disbursements and payments along with delinquency management is one of the key functions banks are usually interested in. TIMVERO has a robust list of pre-installed integrations available.

Collection tools

TIMVERO provides automated bank loan management software from A to Z: from digital loan origination to collection: analytics, decision-making, automated notifications, soft and legal collection, automated interest accruals, and more.

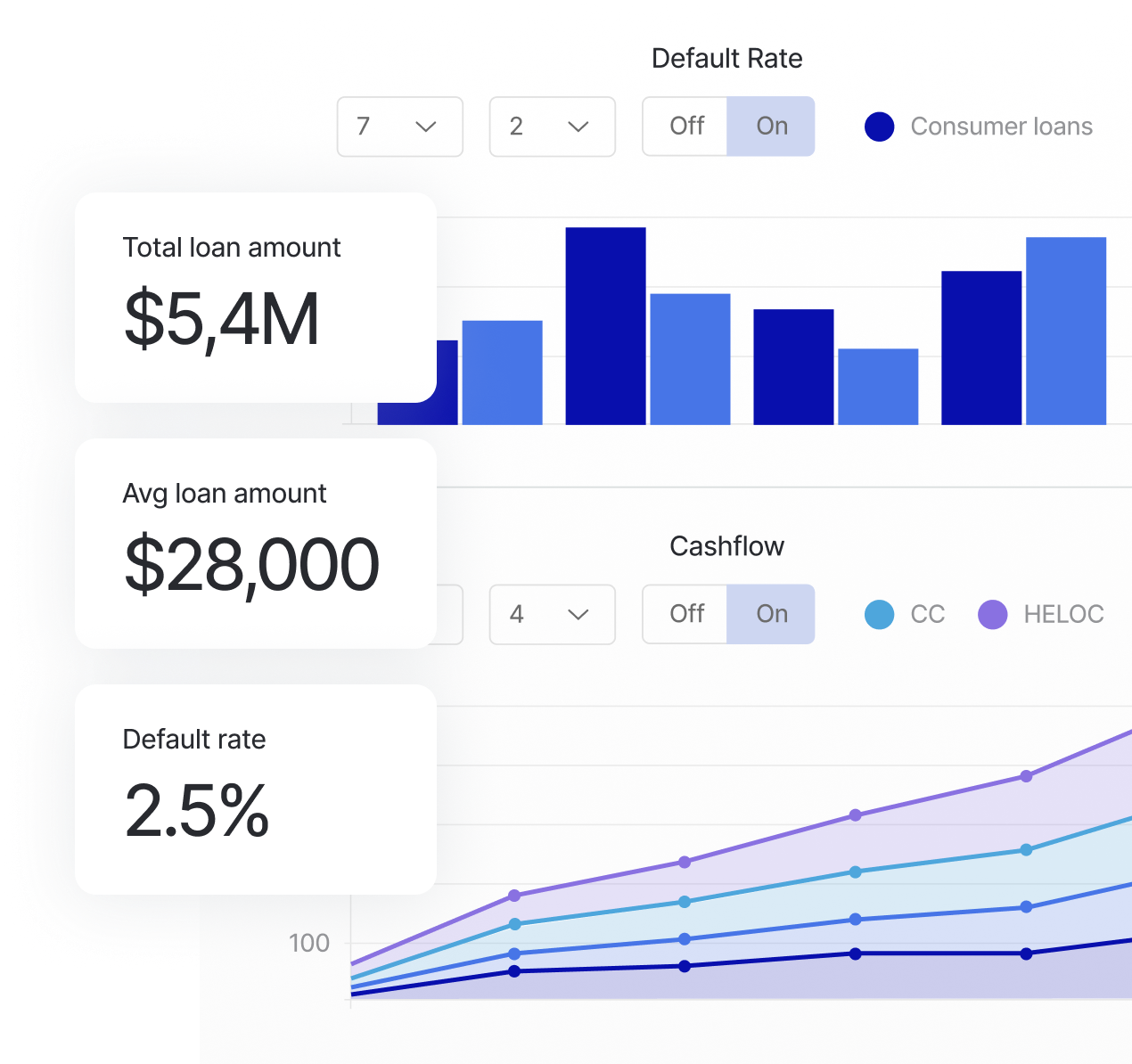

Lending software for banks: analytics

TIMVERO analyzed the requirements and needs of more than 45 North American and European banks to develop to XAI-first (XAI – explainable AI) approach in lending software development for traditional and neobanks.

What’s more: it’s all about no-code efforts and simple implementation of AI-powered data analytics. No need to hire ML engineers, the system does that automatically and supplies departments with valuable lending insights to enable them to make executive decisions up to 12 times faster.

Why it is different:

We created a proprietary AI/ML-powered analytics module that connects to the core loan management platform and boosts its functionality.

The modules monitor, gather and process various data, including customer actions, transactions, or communications data. ML engine creates new risk models, builds marketing and product projection, and finds new collection strategies.

The cashflow projection engine generates genuinely actionable recommendations on how to improve processes, optimize collection efforts, create new loan offerings, etc. It connects various business units: risk, product, marketing, and financial departments, and allows all of them to make data-driven decisions in seconds.

With the help of analytics, banks obtain a clear competitive advantage in their digital lending efforts. They reveal and calculate the impact of all decisions and make them have all the facts in place.

We created a proprietary AI/ML-powered analytics module that connects to the core loan management platform and boosts its functionality.

The modules monitor, gather and process various data, including customer actions, transactions, or communications data. ML engine creates new risk models, builds marketing and product projection, and finds new collection strategies.

The cashflow projection engine generates genuinely actionable recommendations on how to improve processes, optimize collection efforts, create new loan offerings, etc. It connects various business units: risk, product, marketing, and financial departments, and allows all of them to make data-driven decisions in seconds.

With the help of analytics, banks obtain a clear competitive advantage in their digital lending efforts. They reveal and calculate the impact of all decisions and make them have all the facts in place.

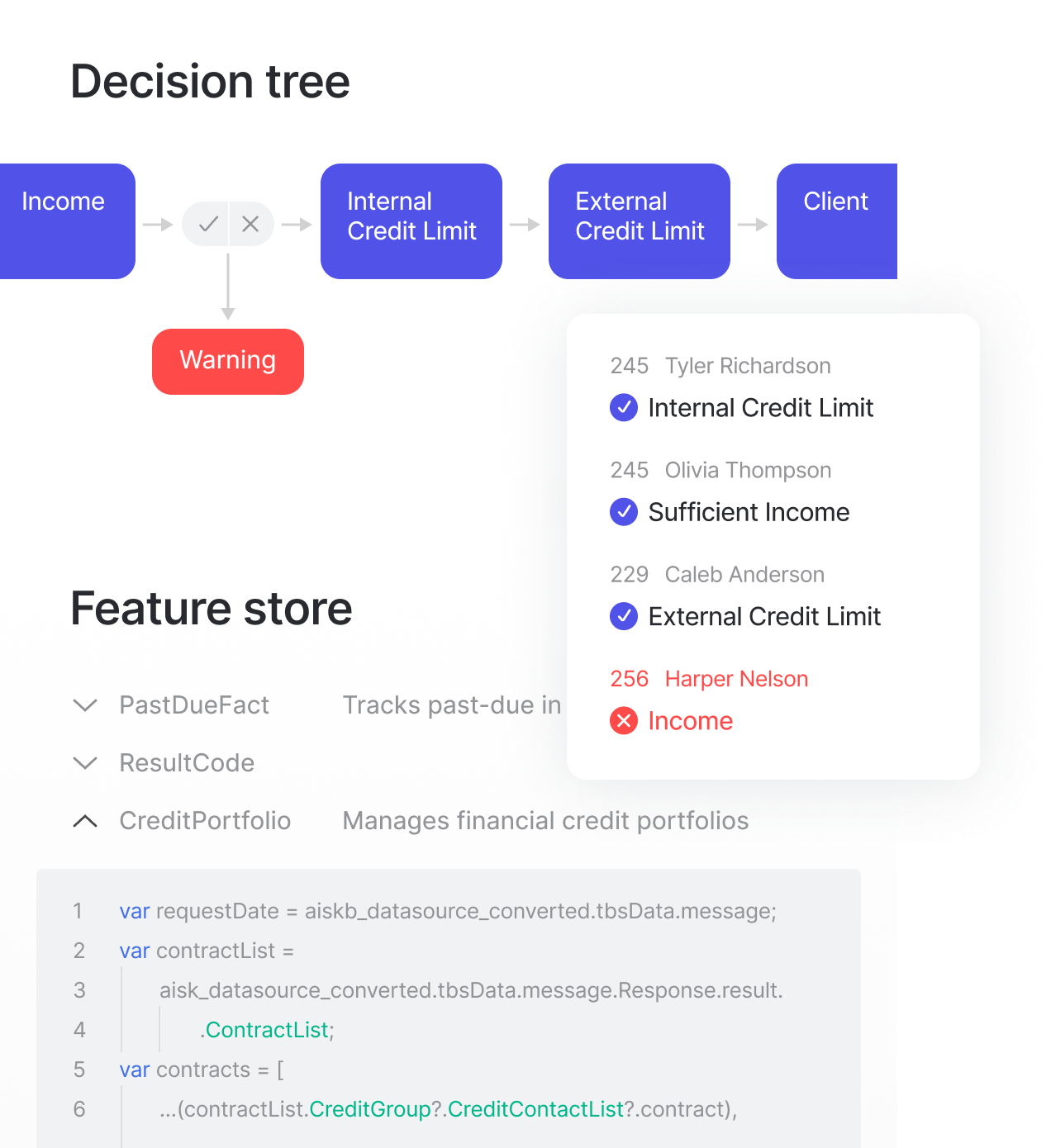

Data-driven decisions in banks

Banks tend to have their own scoring approaches and score cards, however, timveroOS provides additional methods of scoring automation, check it out:

TIMVERO packs the bank loan origination software with a highly customizable underwriting engine paired with an open-source BPM module. Bank officers can set it up using their logic and time-proven techniques.

The system is integrated with the ML engine and with the cloud DWH module – both are proprietary and flexible. Such technically advanced loan origination software for banks allows them to do the following things:

- Operate with no software engineering on the daily basis: just connecting the necessary functionality from the ready-made feature marketplace (like nodes, checking, or paths)

- Create and customize loan products, terms, and amounts based on market research

- Tailor underwriting processes and introduce edits in minutes, not days or weeks.

Customer reviews

Lending software for fintechs

TIMVERO also delivers robust loan management solutions for fintechs and alternative lenders. The lending solutions include digital loan origination, automated scoring, disbursement, and loan servicing - all powered up by enhanced analytics.

Lending software for fintechs

TIMVERO also delivers robust loan management solutions for fintechs and alternative lenders. The lending solutions include digital loan origination, automated scoring, disbursement, and loan servicing - all powered up by enhanced analytics.

Get a demo

Learn about the hidden potential of your bank at the 30-min live personalized demo with TIMVERO. We provide more information about the system, implementation schedules, and approximate costs.

All you need is to leave your contacts in the form, and our team will reach out as soon as possible.